2020 has been full of supply chain disruptions.

When the Coronavirus disease (COVID-19) hit the United States mid-March, it created a domino effect of interruptions. Restaurants and schools closed their doors, employees fled home to work remote and consumers stockpiled frozen pizzas and entrées.

Meanwhile, grocery retailers responded to the almost overnight influx of online orders with curbside pickup, home delivery and buy-online-pickup-in-store (BOPIS).

Foodservice distributors incorporated direct-to-consumer (DTC) channels to keep food moving through the chain.

Software and technology providers fast-tracked development and deployment of new solutions designed to automate, digitize and measure every link in the chain from afar.

At this point, all facets of the cold chain were officially upended.

Factor in natural disasters and civil unrest and it’s these disruptions that have forever transformed the how, what, where and when of grocery retail shopping.

But, many of today’s companies turned such challenges into opportunities to not only improve their own processes, but also mitigate risks, enhance product and just do good business overall.

In fact, the greatest impact on food logistics has been driven by COVID-19, says Susan Boylan, director analyst, Gartner Supply Chain Practice.

“The future of the food logistics will be greatly influenced by macro factors such as government lockdown policies as they continue to battle the pandemic. Foodservice logistics will continue to decline as the constraints such as reduced hours or full closures on the hospitality services continue to be implemented. Logistics operations supporting the retail trade will come under increased pressure as remote working and dining at home is on the increase, driving volume of home food purchases. Perishability and shelf life will also continue to be a key area of focus for food product not consumed under normal demand patterns, which will potentially lead warehouse congestion, waste and inventory write-offs of product. The management of stock loss will need to be a closely monitored process in the months to come,” adds Boylan.

Dark stores light up future of grocery retail

The COVID-19 pandemic is driving an explosion in grocery e-commerce that may transform the industry, according to L.E.K. Consulting. In response, grocers are radically revamping their stores and strategies to meet a dramatically different kind of consumer demand.

Rewind a couple of years ago to when Takeoff Technologies developed micro-fulfillment centers, which are automated grocery distribution facilities located inside grocery stores. Also known as dark stores, the e-commerce boom continues to drive growth in automation among grocery retail.

Since then, Takeoff Technologies has partnered with Albertsons and Associated Wholesale Grocers, among others, to create a “micro-automated warehouse that can be placed at the store level,” says Max Pedró, president and co-founder at Takeoff Technologies.

“Takeoff’s micro-fulfillment solution helps grocers manage two major costs incurred by bringing groceries online—the cost of fulfillment and the cost of the last-mile,” adds José Aguerrevere, CEO and co-founder for Takeoff Technologies. “The micro-fulfillment center brings automation into the store, lowering the picking cost with robotic fulfillment and lowering the last-mile cost with hyper-local fulfillment (by co-locating with existing grocery stores, orders are fulfilled within 3-5 miles of the end-shopper). The cost-efficiency of the micro-fulfillment solution allows grocers to provide online groceries without tacking on extra premiums. This is going to be the future of grocery shopping.”

Meanwhile, Kroger acquired Ocado and its license technology in order to construct several customer fulfillment centers, or robotically controlled warehouses, at locations nationwide.

For its part, Fabric received investment from Kraft Heinz and Evolv Ventures to continue developing micro-fulfillment centers that leverage advanced proprietary robotic technology.

“COVID-19 has catapulted online grocery five years into the future in just a few short months,” says Steve Hornyak, chief commercial officer for Fabric. “Before the pandemic, the only share of grocery sales was roughly 4.5% and was on track to hit double digits by the beginning of 2025. This growth was already causing grocery retailers to pause and consider the sustainability of their fulfillment strategies.”

“I believe we’re entering a new era of ‘Grocery 2.0’ that will combine experiential in-store grocery shopping — food samples, cooking demonstrations, beer on tap — alongside behind-the-scenes automated e-commerce fulfillment, either in the back of the store or in an adjacent property,” he adds. “Brick-and-mortar grocery shopping will never disappear —in fact, the longer we live with the pandemic and the more our lives become digital, I think people will expect even more from their trips to the grocery store. But, at the same time, we’ll all have become accustomed to the convenience of ordering online, and many of those habits will stick. That means retailers will be expected to provide a truly omnichannel experience for their customers.”

The increase in direct-to-consumer business within the food supply chain has also prompted grocery retailers to re-think how product is moved from warehouse to store and back.

“Warehouse automation in the cold supply chain has become more widely used and has shown to be significantly more resilient against the pandemic-related crisis as the reliance on people is greatly reduced,” says Markus Schmidt, president of Swisslog Americas. “Warehouse automation is a key strategy that retailers can make to prepare for the future.”

In response, Swisslog has been focusing on two main areas in the food supply chain, first being the automation of direct-to-consumer picking close to stores.

“For those applications, we have been offering state-of-the-art goods-to-person technologies like AutoStore or Cyclone Carrier. These small automation systems allow a controlled and fast pick of customer orders for either curbside pickup or delivery to homes,” says Schmidt. “The other is the automation of freezer warehouses using either conventional pallet AS/RS (Vectura) or hyper flexible PowerStore AS/RS. These systems provide dense storage with zero labor for storage and retrieval.”

In addition, retailers must embrace alternative technologies “like the mobile retail system offered by Robomart, which provides consumers with an option to ‘hail a store’ as easily as hailing an Uber. Each Robomart can is loaded with groceries and consumers can select exactly, which van they want to hail and shop from,” says Brittain Ladd, chief marketing officer for PULSE Integration. “Another exciting technology is Tortoise Cart, which can hold 100 pounds of products or groceries. Tortoise Cart is designed to make deliveries within three miles of stores. What makes the carts so unique is that they’re teleoperated instead of being autonomous. This allows a remote operator to drive the cart to each customers’ location. The carts are legal to operate on sidewalks and on the sides of roads.”

In addition, retailers can increase their use of artificial intelligence and analytics to sense and respond to disruptions faster and leverage strategies for accelerating the number of perishable products they purchase, adds Ladd.

“What’s certain is this—retailers must create more responsive supply chains with faster replenishment of products to stores,” Ladd adds.

Another trend impacting the grocery retail sector is decentralization.

“Many of the trends we’ve witnessed on the supply chain side have sprung from the immediate shift in consumer purchasing habits thanks to the pandemic. A focus on last-mile delivery is stronger than ever, with cold food chains and brands discovering new ways to cater to consumers opting for home delivery of groceries for health and safety reasons,” says Matthew Goezler, principal of MG2. “One trend we’re witnessing is decentralized yet coupled warehousing facilities. While it may be more expensive to have 10 smaller warehouses around the Atlanta metro area, as opposed to one large one near the heart of the city, these decentralized, wider-spread locations allow for more efficient deliveries—saving on fuel and allowing for frozen goods to spend less time in trucks—as well as safeguard your supply chain in the event of one warehouse not being accessible.”

Likewise, the risks and challenges experienced this year have caused disruptions on every level of the supply chain, from fires and smoke in the West preventing the harvesting of crops at the beginning of the chain, to additional health and safety measures slowing down last-mile delivery at the end, adds Eric Marks, principal of MG2.

“The reality we’re facing is these are challenges we’ll be up against for the foreseeable future, and one way for operators to adapt for what lies ahead, starting now, is to maintain a deeper back stock of inventory—2-3 weeks’ worth—in the stores themselves,” he adds. “This shift, of course, will alter the footprint of supermarkets, which currently reserve about 90% of their space for the front-of-house, while only 10% remains for storage and back-of-house stock. However, this shift also plays perfectly into catering to trends that the industry is seeing.”

Foodservice feels the effects

In an expert column published on FoodLogistics.com in February, the Independent Marketing Alliance (IMA) predicted that carryout would be a top foodservice trend in 2020. In fact, 86% of consumers already used off-premise services at least monthly and one-third used them more than they did a year ago, according to a presentation by Technomic.

Fast-forward to present day, and the carryout feature has never been more of an important component of a restaurant’s success than now.

That’s because in March, the International Foodservice Distributors Association (IFDA) projected the foodservice industry would lose $24 billion through June, as COVID-19 shut down restaurants, schools, daycares and hotels.

Despite several years of growth, the foodservice industry is expected to almost 30% by the end of 2020, following nationwide dine-in bans/restrictions, restaurant closures, job losses and lowered consumer confidence, according to a Mintel study.

Looking ahead though, Mintel predicts total market sales to rebound to pre-pandemic levels by 2023, with limited-service restaurants (LSRs) bouncing back more quickly.

In an effort to lessen the financial impacts, IFDA and FMI-Food Industry Association formed an ad-hoc partnership motivated by widespread consumer needs fueled by COVID-19. The partnership connects foodservice distributors that have excess capacity (products, transportation services, warehousing services) to assist food retailers and wholesalers that require additional resources to fulfill needs at grocery stores.

“Our industries are both committed to the safe delivery of food to consumers, and we are equipped to provide service during this critical time in our country,” Mark Allen, IFDA president and CEO, said in a press release. “This partnership makes sense, and it is in these times of turmoil that we must step up and fill the gaps when we can to help each other where we can.”

On the flip side, drive-thru restaurant visits increased by 26% in April, May, and June, representing 42% of all restaurant visits, according to an NPD Group study. In July, when more restaurants re-opened, drive-thru visits still increased by 13%, the highest visit increase among the service modes of on-premises, carry-out and delivery.

“Before the pandemic, consumer spending was roughly 50/50 between foodservice and grocery/retail,” says Lowell Randel, senior vice president of government and legal affairs for Global Cold Chain Alliance (GCCA). “While foodservice numbers have not yet returned to pre-COVID levels, our members are reporting that demand for foodservice is rebounding. Restaurants in many parts of the country are now open for dine-in, in addition to delivery and carryout. The re-opening of schools and institutions in some parts of the country have also increased foodservice activity. These trends are expected to continue as more parts of the country re-open.”

The pandemic also saw an uptick in meal kit delivery services, with the market size expected to reach $19.92 billion by 2027, according to a report by Grand View Research, Inc. The cook-and-eat offering segment is expected to be the fastest growing segment in the forthcoming years, owing to the convenience and an influx in at-home cooking.

“As employers begin considering their return-to-work strategies and how they will make their offices safe and their benefits supportive of the health and well-being of their employees, providing meal options is a major benefit,” says Sanjay Setty, vice president of procurement and supply chain for Freshly. Freshly for Business is a new B2B platform that ships 50 million meals to over 20,000 zip codes in the United States.Freshly

Freshly for Business is a new B2B platform that ships 50 million meals to over 20,000 zip codes in the United States.Freshly

As a result, Freshly developed Freshly for Business, a new B2B platform that ships 50 million meals to over 20,000 zip codes in the United States.

“In a pre-COVID world, office kitchens became the social gathering hub for meals, mid-day breaks to catch up with colleagues and happy hours. However, as companies of all sizes plan for re-opening, they must reimagine how to maintain the ‘water cooler culture’ associated with kitchens without compromising employee health and safety,” says Setty. “Freshly for Business can help employers offer their team members a single-serve solution that replaces buffet or family-style catered meals that we now know can easily spread germs.”

Another trend cropping up within the foodservice sector are ghost kitchens. Also referred to as dark or virtual kitchens, ghost kitchens are professional kitchen facilities set up to support delivery or carryout meals only.

For instance, Zuul secured $9 million in funding to expand its ghost kitchen operations throughout New York City.

US Foods launched US Foods Ghost Kitchens, a program designed to guide restaurant operators when opening their own operation.

The Kroger Co. partnered with ClusterTruck to launch two on-premise kitchens that will provide a variety of freshly prepared meals on-demand.

Lunchbox partnered with Sodexo and delivery robot startup Kiwibot, to facilitate autonomous and contactless food delivery across the University of Denver. The Eats DU app facilitates campus-wide contactless delivery with Kiwibot’s delivery robots serving as the last-mile solution.

And, Nuro raised $940 million in financing to deploy its custom unmanned road vehicles to pick up groceries and deliver dinner.

Technology saves the day

The next-generation supply chain market is expected to reach $75-plus billion by 2030, according to a report produced by LogisticsIQ. Major drivers of growth entail Big Data, demand for greater visibility and transparency and the adoption of artificial intelligence (AI) and blockchain technologies.

Firms that invested in digital supply chain technologies prior to the pandemic were able to pivot quickly and adapt to changes in demand and buying patterns, according to John Paxton, CEO and COO designate for MHI.

“This proved the concept of the value of digital technologies and is leading to an increase in their adoption,” adds Paxton. “Additionally, firms that had plans in place for supply chain disruption were able to quickly respond to COVID-19. H-E-B, for example, had a pandemic plan in place that it began developing in 2005. It was refined in 2009 in response to H1N1 and later became a yearly influenza plan. This planning served them and their customers well when the effects of the disruption were first felt.”

Digitization is moving faster than many companies anticipated, says Susan Beardslee, principal analyst of ABI Research.

“Five-year plans needed to be enacted in weeks or months, including robust websites that could handle web traffic up 90-200%. Brick-and-mortar store inventory needed to link to warehouse management (WMS) to transportation management (where is my stuff and when is it arriving?) to back-end procurement,” she adds. “The pandemic highlighted where the gaps are for many and who was best positioned to scale quickly. I believe that the convenience of online ordering and delivery options will continue to be valued and expand.”

Case in point: ABI Research forecasts that the supply chain impact of COVID-19 will spur manufacturer’s spend on enterprise resource planning (ERP) to reach $14 billion in 2024. And, that Industry 4.0, localization and contactless delivery will continue to forge ahead.

Likewise, one of the greatest challenges in the immediate to mid-term future is the capacity squeeze for storage in the cold food chain, says Boylan.

“Residual stock with its shelf life ticking away means that warehouses will be operating at higher capacity utilization than usual, thus slowing down warehouse efficiencies and potentially affecting both upstream and downstream logistic flows,” she adds.

A Frost & Sullivan report forecasts growth in big data and analytics because of its power in mitigating risk in business planning, improving operations and serving customer needs.

Additional technologies impacting the future of food logistics entail machine learning, artificial intelligence, wearables, robotics, automation, smart warehousing and more.

“There will be an increased focus on digitalization (95%) and new business models (92%),” says Sarah Watt, senior director analyst, Gartner Supply Chain Practice. “As customer willingness to visit stores declines, home delivery and e-commerce will increase. Lastly, there are questions about supply chain network design, with concerns over restricted movement of goods and potential moves away from globalized supply chains and offshore manufacturing. The circular economy has the potential to provide a new avenue of raw materials through end-of-life reprocessing, local to the markets that these products serve.”

Plus, digital solutions such as Internet of Things (IoT) and advanced analytics “can provide the end-to-end visibility that makes pre-alerts of potential disruptions possible before they happen,” adds Paxton. “This allows for quick and agile course corrections to mitigate disruptions and maintain control.”

The state of freight

The state of freight depends on the pandemic response, according to Dean Croke, principal analyst for DAT Freight & Analytics.

“Fluctuations in the opening and closing of economies and industries like foodservice will likely mean a continuation of what we’ve been seeing for the past five months—imbalanced supply chains, tight capacity and an active spot market.,” he adds. “According to our data, shippers have increased their load volumes on the spot market from roughly 12% on average to approximately 21%. That sent spot rates on their longest continuous rally in the last five years, although they’re starting to plateau now. Contract rates are still 2% below where they were last year, and we expect the year-over-year change in active contract rates to stay below 2019 levels through the end of this year, with average contract rates increasing most likely in Q1/Q2 2021. Of course, everything depends on the economy, the election results and the COVID-19 response.”

Additional DAT analysis shows spot market rates for van and refrigerated (reefer) freight at all-time highs in September. Grocery store chains are adjusting their lean-inventory strategies and have begun stockpiling for a possible surge of COVID-19 cases in the fall and winter.

And, pre-pandemic challenges such as driver shortage have somewhat reversed in a pandemic-stricken world.

“The latest Michigan State University For-Hire Trucking Ton-Mile Index shows capacity tightness at record high levels,” says Croke. “But, unlike early 2018, tight capacity today is driven by a decline in trucking employment as opposed to strong demand. The U.S. Bureau of Labor Statistics reports that drivers are shifting to shorter hauls and local work, which would be good news for local and regional food distributors.”

Meanwhile, growth rates in the logistics industry continue to soar, according to a joint study produced by researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP). Continuing its swift recovery from April’s all-time low overall score of 51.3, the Logistics Mangers Index (LMI) registered at 70.5 in September, its first entry in the 70s since October 2018.

“September’s robust readings are driven primarily by the tightening capacity in both transportation and warehousing, as the demand for logistics services increases ahead of Q4. The tight capacity has resulted in subsequent increases in all price and utilizations, with transportation prices in particular up sharply, matching a two-year high at 87.9,” according to the report.

Rail freight is also impacted with intermodal down by approximately 50%, including from California’s Long Beach and Los Angeles ports, according to ABI Research.

As for air cargo, U.S. airlines carried 6% more cargo by weight in August of this year than in August 2019, according to the U.S. Department of Transportation. The rise was fueled by a gain of 8% in domestic cargo with a 1% rise in international cargo, according to data filed with the Bureau of Transportation Statistics (BTS) by 13 of the leading cargo airlines. These 13 airlines carry 95% of the total cargo by weight on U.S. airlines.

Grocery retailers are also taking advantage of the last-mile boom, with 82% of brands looking to improve their customer’s last-mile experience, according to the 2020 Supply Chain Last Mile Report by eft by Reuters Events in partnership with Dassault Systèmes.

In response, Delivery Drivers Inc. (DDI) partnered with Walmart to introduce Spark Delivery, a crowd-sourced last-mile delivery platform that provides drivers with the ability to sign up for windows of time that work best for their schedule as well as grocery delivery order details, navigation assistance and more.

“There is an opportunity to support your businesses growing delivery with really great technology that allows for automation, integration and speed,” says Aaron Hageman, CEO and owner of DDI. “There are a lot of things we need in the delivery driver world, like integrated background checks and screening tools or vehicle inspection certifications. Technology can expedite our onboarding process to get these drivers on the road to meet that market demand that is already there. Your customers want delivery today -- your labor-tech can be an advantage.”

When asked about the biggest challenges of the first half of 2020, participants in Averitt’s 2020 Midyear Supply Chain Survey said weak customer demand and the unexpected and often mandated business closures were the largest factors in causing disruptions for shippers.

Averitt Express released Averitt Connect, a browser-based TMS that lets shippers shop carrier-neutral rates from providers across the country.Averitt Express

Averitt Express released Averitt Connect, a browser-based TMS that lets shippers shop carrier-neutral rates from providers across the country.Averitt Express

“Those two issues worked together in a negative synergy that had a far-reaching impact on small- and medium-sized restaurants and retailers,” says Wayne Spain, president and COO Averitt Express. “At the same time, disruptions to international trade created material shortages that slowed down manufacturing and distribution for a period of time. The positive takeaway from our mid-year survey is that many businesses have since adapted to this environment and found ways to keep their operations moving more fluidly. Additionally, the flow of international cargo has also improved.” “When we asked shippers whether they expected an increase or decrease in less-than-truckload volumes in the second half of the year, 61% predicted an increase. With regards to truckload shipments, 35% said they anticipated an increase in volumes. The optimism we see from shippers for the second half of 2020 and into next year shows that there will be a continued clash between demand and capacity on the ground, on the water and in the air,” adds Spain.

That’s why Averitt Express released a free less-than-truckload transportation management system (TMS). Averitt Connect is a browser-based TMS that lets shippers shop carrier-neutral rates from providers across the country, and allows users to book, track and manage shipment history all from one easy-to-use platform.

“Simply put, the best advice that can be given to shippers is to strengthen the partnerships they have with their service providers,” he says. “Every industry is in the same boat when it comes to transportation challenges during these challenging times. Planning for capacity constraints and even considering strategic inventory placement within key markets ahead of another potential disruption could be the key to avoiding trouble down the line.”

Prior to COVID-19, e-commerce growth year-over-year averaged in the mid-teens, according to Steve Sensing, president of global supply chain solutions for Ryder System, Inc. In the second quarter, that jumped to 45%, according to the U.S. Census Bureau’s quarterly retail sales report.

“We expect e-commerce sales to remain strong, as consumers get more and more comfortable with buying food online, curbside pick-up and app-based delivery partnerships,” he says. “Add to that the technology that is driving the evolution of smarter, faster and more efficient supply chains – factors that are paramount in the cold food chain where time and temperature concerns are paramount.”

That’s why in May, Ryder rolled out a one-of-a-kind, real-time visibility and collaborative logistics platform called RyderShare.

“The customer-centric solution integrates multiple transportation and warehouse management systems, enabling all parties involved in moving goods through a supply chain to easily see potential problems, collaborate in real-time and take proactive action to course-correct, an ability that is particularly valuable to the food and beverage industry, where maintaining time and temperature controls is critical,” Sensing adds.

Ryder also received FDA food-grade certifications for three of its e-commerce fulfillment facilities, including a new 600,000-square-foot facility near Philadelphia.

This spring, DAT introduced Ratecast, a new tool that forecasts rates for the next 52 weeks for long-term planning and eight-day forecasts for short-term pricing decisions.

DAT also introduced the Market Conditions Index (MCI), a supply-and-demand metric that provides a clear view of the demand for trucks now and in the future based on load and truck postings, historical trends, normalized post and search behavior and outbound volume.

Meanwhile, earlier this year, FedEx introduced the FedEx SameDay Bot, an autonomous delivery device designed to help retailers make same-day and last-mile deliveries. With the bot, retailers can accept orders from nearby customers and deliver them by bot directly to customers’ homes or businesses the same day.

To remain competitive, Uber Freight launched Uber Freight Enterprise and Uber Freight Link enterprise software solutions. Uber Freight Enterprise enables enterprise shippers to gain end-to-end control of their freight, where shippers can source capacity through Uber Freight’s vast marketplace with controls to adjust coverage and pricing. And, Uber Freight Link expands the enterprise platform, with innovative execution software for loads outside of the Uber Freight network, and delivers one-tap tendering, superior real-time visibility, proactive exception management and digital documentation.

“Temperature-controlled supply chains have always required particularly close coordination between shippers and carriers,” says Joe Shone, enterprise partnership strategy and growth for Uber Freight. “We saw a growing demand from enterprise businesses to manage their supply chain and logistics networks as capacity tightened and consumers’ grocery and dining habits shifted during the pandemic. We saw multiple shippers bundle low-volume freight. Finding consistent capacity for this type of freight is extremely difficult in tight market conditions and comes at a high surge cost. When customers are able to bundle all these low-volume lanes together and award a daily load commitment out of facilities or regions, the freight turns from undesirable to desirable for carrier partners within networks like ours.”

“One of the biggest risks that was uncovered during this past year was around supply. With a sudden a change in demand, many food and beverage manufacturers and distributors found their supply chain networks were not diversified adequately, and they struggled to keep up. Understanding how to mitigate that type of risk in the future is something that comes with years of experience,” Sensing says. “Logistics professionals who manage disruption day in and day out know how to engineer supply chains that not only flex with planned seasonality or unexpected events, but also deliver cost savings, increase productivity and improve efficiency. When done right, supply chains are a competitive advantage, which makes outsourcing to a 3PL or 4PL a competitive advantage. Make sure you capitalize on that.”

For its part, Suddath instituted paperless inspections and internal electronic audits, which enabled the company to train its workforce year-round and ramp up internal audits during the pandemic.

“By switching to paperless inspections and electronic audits prior to the pandemic, we were prepared to keep our customers’ supply chains strong while minimizing risks. Because our employees were already trained and operating this software, it enabled us to quickly react and support our customers when travel restrictions and minimal in-person contact were impacting other organizations,” says Trish St. John, vice president, safety and quality assurance, moving and logistics for Suddath. “Another technology change Suddath is implementing is adding more sensors for continuous monitoring in our temperature-controlled storage areas. Manual temperature and humidity monitoring are a standard at Suddath, but the enhancement is linked to our paperless and virtual internal audit programs. This will further expand technology use and propel us to rely less on manual-in person recording.”

The COVID-19 pandemic also brought to light new vulnerabilities with constantly evolving state and federal regulations.

“Conducting vulnerability assessments year-round is key to reducing risks. At Suddath, we were already conducting regular assessment to determine necessary changes and align with client requirements,” St. John says. “During the pandemic, we increased the frequency to protect our employees, partners, customers and their end-customers. We were able to quickly adjust for things like occupancy limits, workplace redesign and security requirements, while ensuring we’re still meeting regulations like food defense, fire and safety and OSHA standards.”

The rise and fall of imports/exports

Imports at major U.S. retail container ports are expected to remain significantly below last year’s levels into this fall as the impact of the COVID-19 pandemic continues, according to the monthly Global Port Tracker report released by the National Retail Federation and Hackett Associates.

The value of exports from Latin America contracted by 3.2% in the beginning of 2020 compared to the same time period in 2019, according to a report by the Inter-American Development Bank. Although in recent years, China had been the main driving force behind Latin America’s external sector, its demand for imports came to a standstill.

Inter-American Development Bank’s report also detailed that the first sub-region to experience the trade contagion of the COVID-19 pandemic was South America, whose exports are concentrated in commodities. Its exports contracted at an estimated rate of 7.6% after dropping 6.2% on average in 2019.

Mesoamerica’s export growth slowed from 2.5% in 2019 to 1.3% in year-on-year in the first quarter of 2020, which reflects the downturn in the growth of Mexico’s external sales (0.6%). Continuing a trend that began in mid-2019, exports from Central America accelerated remarkably, increasing by 9.1% year-on-year in the first quarter of 2020. However, both trends reversed in March, mainly because of declining demand from the United States.

What’s more is, the World Trade Organization (WTO) expects global trade to fall 13-32% in 2020, likely exceeding the trade slump brought on by the 2008-09 global financial crisis. (Check out Food Logistics’ May 2020 issue on ports and ocean carriers to learn more).

On the other hand, the rise in demand for cargo transportation through ships and an increase in trade-related agreements continue to boost growth in the global shipping containers market.

In fact, the global shipping containers market accounted for $8.70 billion in 2018 and is projected to garner $12.08 billion by 2026, growing at a CAGR of 4.3% from 2020 to 2027, according to an Allied Market Research study.

For example, through the Maritime Administration’s (MARAD) Port Infrastructure Development Program, the U.S. Department of Transportation Secretary Elaine Chao awarded more than $220 million in discretionary grant funding to improve port facilities in 16 states and territories of which eight are located in Opportunity Zones, created to revitalize economically distressed communities using private investments.

Likewise, the Georgia Port Authority (GPA) handled all-time record volumes in the month of August at Port of Savannah, and based on cargo bookings, is projecting more than 5% growth compared to September 2019.

The Port of Los Angeles unveiled the Port of Los Angeles Signal, a service powered by Wabtec’s Port Optimizer that delivers a dashboard view of how many shipments will be arriving in Los Angeles over the next three weeks.

And, Port of Oakland’s largest marine terminal cut diesel emissions from all 13 of its massive yard cranes by 95% after retrofitting them with hybrid electric engines, further eliminating about 1,200 metric tons of greenhouse gas emissions annually from each crane.

How cannabis, packaging and sustainability fit in food logistics’ future

FMCG Gurus research shows that attitudes toward packaging are changing for the better as consumers seek reassurance to food safety and protective packaging.

Meanwhile, an L.E.K. Consulting survey conducted just before COVID-19 reveals that nearly 50% of consumer packaged goods (CPG) brand owners expected to boost their spending on packaging, up from 41% who said the same in last year’s survey.

According to the study, in the last two years, a majority of brands introduced environmentally friendly products (67%) and packaging (53%); 42% of brands switched a portion of their packaging to recycled substrates; 36% embraced some form of biodegradables; and 35% made efforts to use lightweight materials to reduce the amount of packaging. And, about 23% of brand owners said that consumer demand of green products and services will be the biggest growth driver for their primary brands over the next two years.

Another major packaging trend is the increased interest in sustainable packaging with less plastic.

“Food and beverage industry players are looking for ways to minimize their carbon footprint, and packaging has a big role to play in this respect,” says Thomas Körmendi, chief executive officer of Elopak. “According to the Food and Agriculture Organization, if food waste were a country, it would have the third highest GHG emissions in the world. Good packaging design prioritizes safety, but also helps consumers to minimize this waste. For example, using easy-fold lines that help the consumer to squeeze out any remaining product.” Elopak's Pure-Pak Imagine is said to be the world’s most sustainable carton.Elopak

Elopak's Pure-Pak Imagine is said to be the world’s most sustainable carton.Elopak

That’s why in in June, Elopak launched Pure-Pak Imagine, what is said to be the world’s most sustainable carton. Pure-Pak Imagine is a modern version of the company’s Pure-Pak carton, containing 46% less plastic and is made with 100% forest-based Natural Brown Board.

“The future of food logistics must be circular, with sustainability at its core,” says Körmendi. “We need to think about the full cycle of each product throughout the supply chain, from the renewability of the inputs used, through its journey to the consumer and eventually its recyclability. Introducing regular systematic risk evaluations is an effective way to make sure potential disruptions are identified early on and action is taken to mitigate any impact. As 2020 draws to a close, it is important for us to evaluate the performance of the measures we have taken and assess which we should continue with as we come out the other side of this pandemic.”

From 2015 to 2019, sustainability-marketed products contributed 54.7% of overall CPG market growth while representing 16.1% dollar share of the category in 2019, according to IRI.

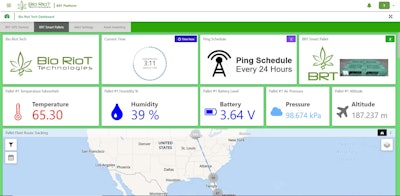

Carbon footprint and the fight against climate change will also have an unprecedented impact on the future of food logistics. Technologies such as barcode, QR code, RFID, Bluetooth and IoT sensors are rapidly evolving, says Michael Laible, founder and CEO of Bio Riot Technologies Inc.

Technologies such as barcode, QR code, RFID, Bluetooth and IoT sensors are rapidly evolving.Bio Riot Technologies Inc.

Technologies such as barcode, QR code, RFID, Bluetooth and IoT sensors are rapidly evolving.Bio Riot Technologies Inc.

“Reusable packaging programs and circular operating models will provide the infrastructure for an intelligent supply chain. This allows the supply chain to be digitized in new areas [that] provides numerous food safety and operational benefits, product recalls, spoilage optimization, see-to-sale tracing, etc.,” Laible adds. “Food packaging is a substantial global sustainable problem that needs new technologies, solutions, regulations to drive a lower carbon footprint across the food supply chain. Companies that can implement technologies that drive efficiencies and sustainable benefits through the organization are positioning themselves for a successful future. Reusable pallet programs that are accounted for intelligent assets over packaging costs is one example of organization sustainable operational decision. The fight against climate change will continue to evolve. This will waterfall through organizations and how they operate from a sustainability standpoint.”

What’s more is, cannabis plays an integral role in the future of food logistics.

A Nielsen study says cannabis sales in the cold food and beverage market could rise to more than $40 by 2025.

“We will see the largest cannabis growth in the consumer edibles market as cannabis works itself into the mainstream food and beverage industries,” Laible says. “The use in medical applications will also continue to expand, which will drive new cold chain handling requirements. Temperature-sensitive products and cannabis require sophisticated tracing, packaging, handling, storage, distribution systems to operate with compliance. The abundant and growing demand in these sectors are driving a rapid evolution of cold chain solutions.”

Environmental initiatives like carbon neutrality and food waste reduction are going to continue shaping the food supply chain—from production to delivery, says Ray Hatch, chief executive officer for Quest Resource Management Group.

“If 2020 has taught us anything, it would be the fact that the more sustainable a supply chain operation is, the less likely it is to see major impacts from changes in the market. Sustainability, transparency and ethical sourcing are considered to be among the most important trends affecting any food and beverage company. Things like publishing Corporate Sustainability Reports are quickly becoming an industry requirement, instead of an industry trend, and they require accurate data. You can have the greatest recycling program around, but if you can’t show the actual data to support it, it doesn’t matter,” he says.

“Better packaging options, more efficient logistics and smarter operations need to start at the beginning of the food production cycle,” Hatch adds. “Every bit of waste created at the beginning of the supply chain gets passed on to the end. For example, when grocery stores had a huge influx of business in early 2020, they also had a huge influx in waste, specifically, cardboard. Although the food producer isn’t responsible for the waste it creates with its packaging because the grocer ends up with it, that waste still has an impact on the supply chain as a whole.”

That’s why many of today’s cold food and beverage processors are also implementing initiatives to become more sustainable.

For instance, Smithfield Foods became the first major protein company to commit to becoming carbon negative in all company-owned operations in the United States by 2030.

Duncan Family Farms announced plans to install a highly effective, controllable and transportable treatment system for irrigation water.

FoodMaven looks to becoming more of an agile food system through flexibility, adaptability, eliminating food waste, reducing time and distance that food travels and ensuring food security worldwide.

Cargill set new global water targets to achieve sustainable water management in its operations and all priority watersheds by 2030.

In the shipping sector, 95% of shipping executives interviewed for a report produced by Shell, Deloitte Netherlands and Deloitte UK view decarbonization as a Top 3 priority.

And, Orange EV and McLane Co. deployed Orange EV T-Series pure-electric terminal trucks to McLane Foodservice’s distribution center in Riverside, Calif., to help reduce the company’s environmental impact.

Next Normal becomes New Normal

There’s no denying that consumer behaviors are changing, says Marks.

“These fundamental shifts will not only continue to drive change at the individual store level, but the ripple effects of these changes will completely alter the food logistics industry, perhaps for good,” he adds. “While we’d love to gaze into a crystal ball and predict what lies ahead, we must remember that it is the consumer who holds all of the power, and subsequently the keys to what the industry’s future holds. As their behaviors continue to evolve in a post-pandemic world, the best thing the supply chain can do is to remain nimble to meet those demands.”

For one thing, the pandemic has placed a spotlight on the critical work of all players across the supply chain, making the essential worker an even more essential piece to the supply chain puzzle, according to Randel.

“Just before the pandemic, GCCA completed an industry trends survey that found 90% of respondents believe their companies will be more successful in the next five years, and 93% indicated that they believe the [supply chain] industry will grow in the next five years. This optimism has persisted even in light of the pandemic,” Randel says. “Our recent COVID-19 Cold Chain Business Impact Survey shows that 48% believe that the growth rate of the industry will increase as a result of the pandemic (50% no change and only 2% decrease in growth rate).”

The GCCA impacts survey identified several trends that cold chain companies believe will stick around post-pandemic.

· 46% anticipate an increase in outsourcing by customers (50% no change, 1% decrease).

· 74% expect growth of e-commerce/direct to consumer delivery of chilled and/or frozen product as a result of the pandemic (24% no change, 2% decrease).

· 48% of respondents believe there will be an increase in diversification of temperature-controlled products in food industry post-COVID.

“2020 has been a challenging year that has tested the food supply chain,” says Randel. “While there were some short-term disruptions, the food supply chain demonstrated remarkable strength and resilience. The food logistics is normally not a ‘front page’ issue, but the pandemic has placed a spotlight on the critical work of all players across the supply chain. As a result, consumers, policy makers and others now have a deeper appreciation for food logistics and the future of the industry is bright.”

2020 will also be remembered as a wakeup call for many businesses and shippers involved in food logistics, says Spain.

“Throughout the course of the year, many retailers have struggled with empty shelves because of supply chain disruptions linked to the pandemic. The distribution of a potential COVID-19 vaccine is predicted to cause major disruptions within the national and global cold food chains,” he adds. “For many shippers, it may be worthwhile to explore dedicated fleet options. Companies should hope for the best, but plan for the worst. They should begin aligning themselves with service providers that can meet their capacity needs, especially in the months and year to come.”

Sustainability also remains a key focus for consumers despite all the turmoil of 2020.

“Businesses need to focus on all of the aspects of sustainability—social, economic and environmental. The environmental and social aspects of sustainability get all of the attention from consumers, but without economic sustainability, businesses wouldn’t be able to make it through years like 2020,” says Hatch.

Pandemic events have taught us that, now more than ever, we need nimble, flexible and resilient supply chains that can sustain even a global disruption, says Sensing.

“Analyzing current capability sets and geographic reach will give manufacturers and distributors insight on where they need to make improvements in their ability to scale operations faster, be more reliable to their customer base and control cost, while maintaining customer service levels,” he adds.

And, when COVID-19 is over and the nation can migrate into to the Next Normal, “businesses that have used this crisis well by embracing supply chain innovation, diversification and disruption planning will win the future by having supply chains that are faster, more efficient and more resilient,” says Paxton.