As of press time, inflation still exists, with climbing diesel prices causing financial stress for carriers and a rise in prices of finished goods being felt by consumers.

Companies still strive to nearshore, especially as the Hamas-Israel and Ukraine-Russia Wars hammer on.

Strikes at ports fused with unpredictable weather events pose additional challenges.

And, the influx in cargo theft, cybersecurity concerns and ever-changing industry regulations continue to threaten the safety and security of tomorrow’s supply chains.

But, when it comes to the State of the Supply Chain, the implementation of technology mixed with the ability to be flexible, nimble and versatile will enable the logistics world to pivot accordingly.

It’s anyone’s and everyone’s game to succeed.

Here’s a breakdown of top 10 trends to watch in 2024, along with an outline of the State of Transportation, State of Grocery E-Commerce, State of Software and Technology and State of Sustainability as it relates to the cold food chain.

Top trends to watch in 2024

Cargo theft. According to BSI’s Supply Chain Risk Insights Report 2023, food and beverage products were the most stolen products in 2022, and as Q2 of this year, are being stolen at a rate of just over 2:1 of the next most stolen product, according to Erica Bressner, business intelligence analyst, BSI.

“A major contributing factor in the high levels of F&B being stolen was inflation, which was at about 9% in 2022 compared to wage growth of only about 5%,” Bressner says.

CLICK HERE to read an exclusive interview with Erica Bressner from BSI.

Automation and GenAI. Automation is expected to be a driving factor in the progression of the supply chain industry, especially amid ongoing labor shortages, says Jacob Olson, director, solutions, Cleo.

“Automation of end-to-end workflows is transforming the industry by creating more efficient and resilient processes. Not only automation, but use of intelligence, specifically generative artificial intelligence (GenAI), will be increasingly helpful for demand forecasting, customer service and support,” Olson adds. “Some organizations are already leaning into more strategic uses of GenAI, including across operational functions such as procurement, production, and sales.”

What’s more is, automation is a means to an end.

“No matter the objective (lower cost, higher productivity or efficiency, mitigating labor risk, etc.), automation opportunities continue to be explored by many organizations to ensure long-term success rather than be subject to short-term volatility,” says Kira Bilecky, senior supply chain consultant, St. Onge Company. “Investments remain high, but benefits continue to improve as well.”

Automation is expected to be a driving factor in the progression of the supply chain industry.Cleo

Automation is expected to be a driving factor in the progression of the supply chain industry.Cleo

Emerging technologies. As Internet of Things (IoT) technologies like sensors (RFID, GPS, eSIMs, etc.), cloud data storage and artificial intelligence (AI) and machine learning (ML) prediction models mature, the more likely companies can better track shipments in transit in real-time, according to Chris Pickett, COO, Flock Freight.

“We believe that not only can we dramatically improve the overall reliability of the food and beverage supply chain, but better visibility tech can also be leveraged to better utilize the transportation capacity in a marketplace that remains as fragmented as it’s always been,” Pickett adds.

CLICK HERE to read an exclusive interview with Chris Pickett from Flock Freight.

To piggyback on the visibility trend is the growing adoption of these digital technologies to improve efficiency, visibility and traceability.

“This includes technologies such as AI, ML, big data analytics and IoT. For example, AI can be used to predict demand, optimize transportation routes, and identify potential disruptions,” says Jim Bresler, director of product management, food and beverage, Plex by Rockwell Automation.

CLICK HERE to read an exclusive interview with Jim Bresler from Plex by Rockwell Automation.

Also crucial to AI is data, says Ryan Leigh, CTO of Bringg.

“Not only crucial to drive AI functions, customer data is the fuel for true optimization, empowering businesses to make crucial decisions around delivery prices and offerings based on customer loyalty and lifetime value to create more efficient and profitable strategies. This will become increasingly important to grocers of all sizes,” he adds.”

AI also has great potential to be a force for good, making supply chains more robust and efficient, Bressner says.

“But of course, there is a role for building trust too. BSI’s Trust in AI poll of 10,000 people around the world found that 77% of people said complete or at least some level of trust is needed for AI to be used to enable ethical supply chain management,” Bressner adds.

Cold food supply chain companies are also using predictive analytics to anticipate disruptions and make better decisions, Bresler says.

“This helps them to reduce waste, improve efficiency and increase customer satisfaction. For example, predictive analytics can be used to predict demand surges, identify potential transportation delays, and forecast the risk of food spoilage,” adds Bresler.

Warehousing constraints and the rise of 3PLs. As the digital transformation of retail continues with e-commerce now accounting for +15% of the total, Pickett says, consumer tastes are evolving faster than ever before.

“Building supply chain agility and nimbleness will be key. Those that can adapt to shifting consumption patterns the quickest will outpace those that can’t. So again, this one is all about velocity,” adds Pickett.

Despite facing continued challenges of capacity constraints, labor shortages and rising operational costs, 94% of third-party logistics (3PL) providers reported an increase in sales within their last measurement period, an increase from the 88% who reported the same in 2021, according to an Extensiv report.

What’s more is, the fourth-party logistics (4PL) market will continue to grow, and collaboration between 4PLs and 3PLs will help counter industry consolidation. Plus, omnichannel fulfillment will continue to grow for direct-to-consumer (DTC) and business-to-business (B2B) markets, leading 3PLs and 4PLs to experiment with micro-warehousing and optimize fulfillment times.

3PLs also leased more big-box (200,000 square feet or larger) warehouse space in North America than any other occupier category, according to a CBRE report. Accounting for 41% of all big-box lease transactions in 2022, 3PLs expanded their footprints and claimed the largest share for the first time since CBRE began tracking the activity in 2012.

Plus, over the past two years, 50% of shippers increased their spend with outsourced providers, compared to only 12% that decreased spend, according to a Coyote Logistics study, and 82% of shippers rely on 3PLs to procure capacity for at least some of their freight, with 38% using 3PLs for a majority of their shipments.

Freight recession. The trucking industry has been in a freight recession since basically Q2 of 2022. And, while some analysts believe that a new freight cycle will begin soon, others believe truckers won’t see any meaningful increase in rates until at least the second quarter of 2024, according to Lewie Pugh, EVP, Owner-Operator Independent Drivers Association (OOIDA).

“Two things need to occur before we enter the next up-cycle -- demand surges to such an extent that it outstrips available supply, and contract rates and spot rates inverse, meaning spot rates must exceed contract rates,” adds Pugh.

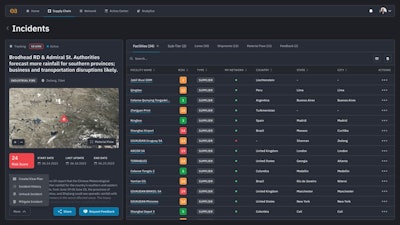

Extreme weather, unpredictable geopolitical landscape and environmental implications. There are three immediate – and constant – threats to the global cold food and beverage landscape that tend to interchange. One of the most immediate though is extreme weather, “which is causing widespread fires, flooding, and drought, leading to agricultural losses, and prompting countries to take an isolationist approach to their food supply, cutting off exports of critical foodstuffs like grains, sugar, rice, and edible oils,” says Julie Gerdeman, CEO of Everstream Analytics.

CLICK HERE to read an exclusive interview with Julie Gerdeman from Everstream Analytics.

In fact, the strengthening of El Niño will play a significant role in the weather across the United States throughout the entire winter season, according to AccuWeather. A shift in the polar vortex could open up the gates of the Arctic to unleash frigid air across the central and midwestern U.S. late in the winter, resulting in some of the coldest conditions of the season.

And, war and trade restrictions will continue destabilizing food chains and exacerbating global food shortages, Gerdeman says, and increased scrutiny of environmental and labor implications in global food supply chains will cause further disruptions, “as forced, and child labor allegations, ecological degradation, and current and emerging supply chain regulations will lead to production halts and sourcing issues of critical ingredients and inputs,” she says.

Extreme weather, unpredictable geopolitical landscape and environmental implications pose an added layer of challenges to today's supply chains.Everstream Analytics

Extreme weather, unpredictable geopolitical landscape and environmental implications pose an added layer of challenges to today's supply chains.Everstream Analytics

Nearshoring, risk mitigation and building resiliency. The top supply chain trends to watch in 2024 include a keen focus on mitigating supply chain risk, reshoring and nearshoring to source reliable production closer to customers, finding backup sources of supply, creating resiliency in the end-to-end supply chain, digitizing the supply chain, and keeping an eye on cybersecurity threats, according to Lisa Anderson, president, LMA Consulting Group, Inc.

“Since there is heightened risk in the global supply chain due to geopolitics, conflicts over natural resources, ongoing concerns related to the Russia-Ukraine war, South China Seas, new threats in the Suez Canal related to the Israel-Hamas conflict, Panama Canal issues related to drought, and concerns about natural disasters, labor negotiations/labor shortages, and cyber threats, smart executives are taking control,” she adds.

Sustainability. Despite all of the challenges and disruptions the supply chain industry faces, sustainability still remains a key trend for 2024, especially as companies race to deliver on their net-zero commitments by 2030.

“In many sectors, Scope 3 emissions can account for up to 80% of a company's total emissions. Lowering Scope 3 presents one of the most significant opportunities for decarbonization, and the industry will look for opportunities to gain operational efficiencies,” Gerdeman says. “For example, our clients are using our analytics to optimize the mode, route, and equipment selection for temperature-sensitive goods, saving money by protecting products from freezing or spoilage, reducing refrigeration costs when cold blankets do the trick, reducing fuel costs, and lowering their carbon emissions.”

In fact, global food and beverage production accounts for roughly 34% of global greenhouse gas emissions (GHG), and according to the Food and Agricultural Organization, the food and beverage supply chain is on track to become the industry’s largest polluter. OXFAM found that the emissions of 10 of the largest food and beverage fleets equaled the total emissions of all Scandinavian countries combined.

Visibility also plays a role in helping supply chains go green.

“Recent years have seen the emergence of visibility platforms, highlighting their ability to foster greater efficiencies, enhance information sharing and (hopefully) lower costs. But visibility has another role to play in enhancing traceability and transparency efforts. There’s huge upside in potentially reducing Tier 2 and 3 emissions, which could comprise up to 80% of total carbon for CPG companies and similar benefits in terms of ensuring supply chains are free of forced or child labor, among other noble goals,” says Tom Madrecki, VP, supply chain, Consumer Brands Association.

Go to https://foodl.me/77d66r43 to watch a webinar with Madrecki on the State of the Industry.

Increasing regulations. New regulations are likely to shape food and beverage supply chains, especially as they relate to environmental, social, and governance (ESG) reporting in the European Union (EU), Bressner says.

“However, the requirements entailed by these requirements will also shape the agricultural and food industries in other countries, especially those in South America, as export markets work towards compliance. Namely, these regulations include the Regulation on Deforestation-free products, the Proposal for a ban on goods made using forced labor, and the Directive on Green Claims,” Bressner adds. In April, the California Air Resources Board (CARB) approved the Advanced Clean Fleets rule, a first-of-its-kind ruling that requires a phased-in transition toward zero-emission medium-and-heavy duty vehicles by 2045. What this means is, fleet owners operating vehicles for private services such as last-mile delivery and federal fleets will begin their transition toward zero-emission vehicles starting in 2024.

“To prepare, fleets should be evaluating the vehicles in their fleet today to determine which vehicles and locations are best suited for electrification and working with manufacturers and utilities to ensure vehicles and infrastructure can be deployed together,” says Alberto Larios, CARB public information officer.

Other regulations with Jan. 1, 2024, compliance dates include:

· Advanced Clean Trucks (ACT)

· Advanced Clean Fleets (ACF)

· Zero-Emissions Powertrain Certification

· Zero-Emissions Transport Refrigeration Unit (TRU)

What’s more, beginning Jan. 1, 2024, trucks must be registered in the CARB Online System to conduct drayage activities in California. Legacy (non-zero-emissions) trucks must register by Dec. 31. Starting in 2025, trucks that exceed their minimum useful life will be removed from the system. Also, starting Jan. 1, 2024, new additions to the registration system must be zero-emissions trucks. And, beginning in 2035, all drayage trucks will be required to be zero-emissions.

“To prepare, fleets should be evaluating the vehicles in their fleet today to determine which vehicles and locations are best suited for electrification, and working with manufacturers and utilities to ensure vehicles and infrastructure can be deployed together,” says Larios.

Company culture. One trend undergoing a severe uptick across all supply chain categories is focus on company culture, implementing diversity and inclusion (D&I) programs and nurturing legacy employees. This is being done through continuous education and enforced worker safety measures. In fact, workplace cultures strong in D&I have been linked in increased productivity, and companies in commercial freight transportation are increasingly formalizing D&I policies, according to the 2023 WIT Index, developed by the Women In Trucking Association (WIT). For example, QAD Redzone launched Redzone University, an online training platform designed to certify frontline operators, supervisors and leaders in the use of the QAD Redzone Connected Workforce solution. The Next Generation in Trucking (NGT) Foundation announced plans to launch a first-of-its-kind NGT Curriculum Companion to support high school commercial driver's license (CDL) programs nationwide. What’s more is, salaries for supply chain professionals continued to rise, with a median income of $98,570, including base and additional compensation, which is up 3% from last year, according to a new study by the Association for Supply Chain Management (ASCM).

State of transportation

The driver shortage still exists, diesel fuel costs are still on the rise and U.S. container imports continue to experience an uptick month-over-month.

But, it was the UPS-Teamsters labor negotiation dispute that set a chain reaction of supply chain disruptions.

“There are obvious lessons to be learned from the UPS and the Teamsters dispute earlier this year. A lot of businesses now understand the need to diversify and manage their risk, and that trend will definitely continue into 2024,” Leigh says. “We’ve seen a big demand for multi-carrier management technology over the past few years; where previously the focus of most projects was on speed; now we see attention shift to capacity planning, quicker onboarding of new carriers, and the mitigation of risk to avoid missing out on profitable consumer revenue.”

According to BSI’s Supply Chain Risk Insights Report 2023, food and beverage products were the most stolen products in 2022.Андрей Журавлев AdobeStock_396129298

According to BSI’s Supply Chain Risk Insights Report 2023, food and beverage products were the most stolen products in 2022.Андрей Журавлев AdobeStock_396129298

Other strikes that created a ripple effect of disruptions was the port strike at International Longshore and Warehouse Union (ILWU) Canada.

“As union-supported labor action gains more ground, especially on the heels of the ILWU win, further strike action by transportation and logistics workers (including railway and airport workers) will likely occur,” Gerdeman says. “The ongoing shortage of truck drivers has been well documented and will continue to make it increasingly difficult to get products from ports to store shelves and drive up prices, as will bankruptcies like Yellow Corp. Prolonged issues with shipping through the Panama Canal will continue to disrupt the transport of dry bulk goods such as grains and soybeans well into 2024.”

CLICK HERE TO LEARN MORE ABOUT AN IMPENDING FREIGHT RECESSION.

The Yellow Freight bankruptcy also created a ripple effect on the industry, one that is still somewhat being felt.

“Customers had to scramble, opportunities arose for competitors, and the supply chain evolved,” Anderson says. “Similarly, the threat of a potential rail strike and West Coast port strike caused customers to transition to alternate modes of transportation and pursue alternate routes. The same is occurring with the UPS strike and the UAW strike as supply chains are moving to account for these types of issues.”

Shipper costs and performance levels are in a better place than peak pandemic panic, Madrecki says, “but we aren’t out of the woods just yet. The underlying issues in terms of labor scarcity remain, as do issues like sagging rail performance and lack of efficiency at ports relative to international peers. ‘Chugging along’ might be the most succinct descriptor.”

CLICK HERE to read an exclusive interview with Tom Madrecki from Consumer Brands Association.

State of e-commerce

E-commerce in grocery didn’t really become a thing until COVID-19 forced several supermarkets and grocery retailers to create a B2C arm of their business almost overnight.

Fast forward to what will be 4 years later, and the rise of e-commerce in grocery is here to stay.

“Across the food industry, retailers, manufacturers, distributors and delivery services have benefitted from this wave of demand in e-commerce and trends indicate that demand will only grow,” says Olson. “The increase in e-commerce sales cements the need for integration of software to fulfill orders, reduce shipping costs, optimize shipping routes and improve visibility for the customer. The popularity of e-commerce is not only its availability but its visibility and traceability of the supply chain, which is made possible through technology. As e-commerce continues to rise, so will organizations’ and consumers’ dependence on software to monitor, integrate and predict outcomes.”

Demand for new channels and new products remains strong.Maksym Yemelyanov AdobeStock_332228476

Demand for new channels and new products remains strong.Maksym Yemelyanov AdobeStock_332228476

Plus, demand for new channels and new products remains strong, Madrecki says.

“The broad theme here is added modal complexity and increasing levels of complexity overall across supply chain distribution patterns. That’s a bigger, arguably more impactful philosophical shift that supply chain executives will be forced to reckon with,” he adds.

Similarly, B2B channels are also growing.

“For example, cold chain needs will explode as computer chip capacity comes online with the expansion of manufacturing with the CHIPS Act,” says Anderson. “Thus, cold chains are expanding at a rapid rate and will continue to thrive in 2024. Cold storage is limited, and even though there are inflationary pressures escalating the cost to build cold storage facilities, growth will be robust. Innovation will be essential to meeting these needs in a way that will provide customer value in a sustainable and profitable manner in 2024.”

On the other hand though, the demand for D2C cold chain and grocery “waned nearly as rapidly as is waxed, as customers returned to in-store shopping to a great (though not equal to pre-pandemic levels) degree, Bilecky says.

“Now, however, cold chain and grocery providers have a preview of what life will be like with increased D2C demand and are identifying the best means to meet that demand as it inevitably grows in the future,” Bilecky adds.

Case in point: The U.S. online grocery market declined 3.1% in September vs. last year, ending the month with $7.5 billion in sales, according to the latest monthly Brick Meets Click/Mercatus Grocery Shopping Survey. Declines in order frequency and spending per order contributed to the drop while an expanded base of monthly users softened the slip in overall sales and signaled continued interest in buying groceries online.

State of software and technology

As a result of the uptick in e-commerce channels, the last-mile underwent its own growth within the cold food chain channel.

From route optimization, driver apps, traceability functions, track-and-trace in real time, predictive analytics and even GPS tracking, “the next iteration of technology will take the complexity of a multi-mode, multi-channel network and internalize it, making decisions using AI and other technologies that will optimize spend and maximize outcomes,” says Leigh. “This means dynamically choosing between modes and channels to cope with consumer demand and flex up or down the capacity of the network. The best tools are starting to take entire batches of daily demand and optimize across channels to plan and execute tasks while still respecting the consumer promise. This allows retailers, grocers, and carriers to focus on their own brand differentiation while still maximizing the bang for their buck in transport spend.”

The growing adoption of digital technologies helps to improve efficiency, visibility and traceability.Plex by Rockwell Automation

The growing adoption of digital technologies helps to improve efficiency, visibility and traceability.Plex by Rockwell Automation

Automation is also critical.

“Time-consuming operations, like inventory purchasing and asset maintenance orders, can be automated to reallocate employee time to focus on more creative and higher value challenges. When organizations automate repeatable tasks, they not only increase productivity but also make jobs at their facilities more attractive to the next generation of workers, who see technology as core to their future and the future of any business,” says Bresler. “By leveraging smart manufacturing technology to automate processes, cold food and CPG companies can extract data from their operations and assemble actionable insights to seek opportunities for profitable growth and transform at pace, despite workforce uncertainties. Technology is also helping the industry accelerate their agility and competitive differentiation, serving as an advantage for manufacturers to improve quality, agility, innovation and attract the next generation of talent.”

And, the use of software that leverages these other emerging technologies such as AI, cloud computing, robotics, IoT and ML is critical to the growth of the cold food supply chain. Doing so automates processes, tracks temperature and shipments and provides visibility to the what, where, why and how of every cold chain product.

However, technology is just a small component of the overall picture.

“While there is a strong focus on real-time in-transit visibility for high-value and temperature-sensitive goods, very little can be done when something goes wrong in transit. While there are opportunities to take corrective actions and avoid a temperature excursion, success depends on many factors, and in practice, is very challenging,” says Gerdeman. “The real value add of this technology is in enabling the wireless download of the environmental conditions experienced in transit. It is common to find that the time and temperature data is never downloaded. It is simply too time-consuming to locate the monitor in the shipment and physically initiate a download of the data. This is particularly true in the food sector. Unless the monitor is alarmed, the data collected by the monitor is never downloaded and stored. Adopting wireless technology guarantees that the full-time and temperature graph will be available because the manual downloading process is virtually eliminated.”

State of sustainability

A main focus for many companies in the cold chain is how to produce and transport temperature-controlled products in the most efficient manner possible. This entails everything from reducing carbon emissions to revamping packaging materials.

“With ESG regulations up 155% globally, regulation overall will continue to shape supply chains in the coming year. Within the EU, companies should not only be aware of [these] regulations but also the potential Corporate Social Responsibility Due Diligence Directive and the European Green Deal, which obligates non-financial disclosures aligned with the Task Force on Climate-Related Disclosures reporting standards,” says Jason Willoughby, business intelligence analyst, BSI. “For instance, in the U.S., regulatory bodies such as the Federal Trade Commission (FTC) and the Environmental Protection Agency (EPA) have Green Guides, which were first issued in 1992 and are updated periodically, to help marketers avoid making unsubstantiated environmental claims that mislead consumers. Compliance with these types of regulations can be crucial to bridging the trust gap and ensuring consumers have accurate information about the products they purchase.”

Implementing visibility in all facets of an organization also aid in achieving most sustainable goals.

“Visibility is the first stop on the route to reduction, and in the last mile, this could take several forms. Route optimization is a great first step, enabling retail businesses to reduce their carbon footprint on a delivery-by-delivery basis and empowering quick results. Of course, green vehicles – such as bikes – can be used in city centers. However, fleet electrification for longer distances will feel like a bigger commitment, requiring a huge investment made over time,” says Leigh.

What’s more is, In the United States, the Security and Exchanges Committee (SEC) is considering certain regulations on supply chain sustainability, such as greenhouse gas emissions, according to Olson.

“This will force businesses to adapt to these increasing regulations. This could lead to a greater use of technology to monitor and inform businesses of climate related sustainability goals, especially to better orchestrate supply chains to optimize transportation routes, reducing food waste and fuel consumption,” Olson adds.

Carbon and emissions data is also becoming increasingly important “in mode and routing decisions, and carriers providing lower carbon equipment and transport will have a competitive advantage,” says Gerdeman. “Governments worldwide are adopting legislation to ensure businesses can’t turn a blind eye to exploitation in their supply chains. We see this with the UK Anti-Slavery Act, the U.S. Uyghur Forced Labor Prevention Act, known as UFLPA, the German Supply Chain Act, the Japanese National Action Plan, and the upcoming EU Supply Chain Act. These regulations include due diligence obligations to counter all forms of forced labor. They hold companies responsible when exploitative labor practices are found anywhere in their supply chains.”

However, supply chain sustainability isn’t just about reducing tailpipe emissions; it also pertains to the products being transported and how those products are moving from Point A to Point B.

“The U.S. wastes 119 billion pounds of food each year. This is an obvious environmental and human issue, but it’s also a business problem. That wasted food equates to $408 billion thrown in the landfill because of surpluses in grocery stores, low crop prices, issues during transportation, and a whole variety of events in foods’ lifecycle,” says Pickett. “In a Flock Freight study released this year, we found that the average shipper had 2,436,137 pounds of product go to waste from damage and lost shipments in 2022. That’s the equivalent of 1 truckload a week per shipper. Effective in 2022, SB1383 requires reducing statewide disposal of organic waste 50% by 2020 and 75% by 2025 in California. It also required grocery stores, food wholesalers, hotels and restaurants to recover at least 20% of disposed edible food for human consumption by 2025. It’s time for supply chain partners to think ahead and contribute to reducing food disposal to help their customers cut costs and comply with emerging state and federal regulations.”

What’s to come in 2024?

While 2023 may have been the Year of Bottlenecks, 2024 opens the door to longevity, peace and prosperity.

CLICK HERE TO LEARN MORE ABOUT WHAT'S IN STORE FOR 2024.

Yet to achieve those elements, companies must be more proactive, more agile and more forward-thinking.

“Instead of being reactive, forward-thinking executives are making the shift to being proactive. Thus, they are setting up a resilient supply chain with the ability to scale up/ down quickly, utilize backup sources of supply, alternate logistics and transportation providers and routes, and educating a cross-functional workforce. They are also rolling out proactive and predictive demand and supply planning programs such as SIOP (Sales Inventory Operations Planning), forward positioning of inventory and capacity, and predictive analytics. As no client has enough high-skilled talent, the best organizations are automating, digitizing, and using robotics, autonomous vehicles, artificial intelligence, IoT and the metaverse (AR/VR) to best utilize limited resources while supplying customer needs,” says Anderson.

Furthermore, “supply chain leaders today must not only be ‘old school’ supply chain experts to drive operational efficiencies and results, but embed themselves within the enterprise, understanding that product development, sales, go-to-market strategy and other facets of the business are just as much ‘supply chain’ as anything in their stock job description,” adds Madrecki. “Now more than ever, supply chain executives must be developing the resiliency and reflexes to respond to anything.”

Now, more than ever, we need to become curious, says Gerdeman.

“We must foster cultures of curiosity and be open to using data and technology to dig more deeply to produce the creative solutions needed for the increasingly complex and multi-faceted problems we face. Leading companies are shifting their supply chain tracking and management solutions toward integrated global solutions over previously siloed regional systems. This will give them visibility into the entire network and the ability to understand and mitigate the risks that could impact that network both upstream and downstream. This end-to-end perspective also gives them a view of opportunities to optimize operations, gain a first-mover advantage, and improve ESG performance, ultimately creating more resilient, sustainable supply chains worldwide,” adds Gerdeman.

Collaboration is also crucial, according to Leigh.

“Technology vendors, expert consultancies and carriers all needed to ensure an efficient and successful delivery ecosystem that can adopt to ever-changing demands in the industry,” he adds.

Because supply chains are constantly evolving, supply chain companies are encouraged to make the time and commit the resources and financial support/effort to make improvements within the supply chain, says Bilecky.

“I think we can all agree a day in the life of supply chain or logistics is never the same and something is always on fire. While no one can expect a company to halt their operations to look seriously at improvement opportunities, the classic quality mantra of ‘right first time’ has significant benefits vs. continuing to apply temporary, band-aid type fixes. Companies need to strike a fine balance that helps them remain competitive while also preparing them for the future,” Bilecky adds.

2024 is the Year of Hope. With the help of some supply chain visibility, sustainable measures, more focus on people and the ability to pivot at a moment’s notice, 2024 is anyone’s and everyone’s game to succeed.