*This article brought to you in partnership with DAT Freight & Analytics*

A silver lining for shippers

The impacts of supply chain disruption have become increasingly severe, and, unfortunately, it seems shippers will have to buckle up for continued volatility in the long haul.

Lower freight rates have been the bright spot for shippers amidst predictions and news of doom and gloom. The duration of soft market conditions has surprised analysts, many of whom have since pushed out their predictions of a market turn as far as 2H 2024, with modest rate increases before then.

Savvy shippers have taken advantage of these conditions to gain better control of their supply chains, revamping their transportation management strategy and updating technology. Data and analytics tools have become an essential part of a modern shipper’s tech stack, allowing them to monitor market conditions, shipping lanes, carriers, and costs – inputs needed to make informed decisions.

Real-time insights in action

Dynamic AI-powered data analytics solutions that provide visibility into past, present, and future contract and spot market rates enable strategic sourcing, planning, pivoting, and cost management.

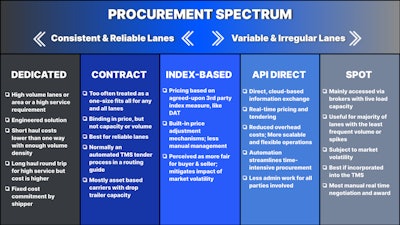

The 80/20 approach to procurement highlights how shippers are better able to navigate challenges with greater agility. Dr. Chris Caplice, Chief Scientist at DAT Freight & Analytics, has demonstrated that approximately 80% of shippers' freight is concentrated on a mere 15% to 20% of their lanes. With more reliable volume, these lanes are often more straightforward to contract and are highly favored by trucking companies.

Locking in capacity for the remaining 80-85% of lanes is more difficult. Caplice argues that the time spent on bidding and contracting for these low-volume lanes is wasted, as they’re often rejected by carriers. Instead, Caplice recommends a shift to dynamic (transactional) pricing in which shippers and carriers agree to tender rates based on pre-established rules. Shipments would flow through the routing guide at the agreed-upon contract rate or going "direct-to-spot" for dynamic pricing – allowing shippers to make the optimal decision in real-time.

The new procurement playbook

With the advent of more advanced technology and real-time data, DAT recommends shippers take these actions for 2024:

- Establish and nurture carrier relationships, especially Tier 1 carriers, to lay a foundation for success in the coming tight market cycle

- Segment transportation networks based on lane characteristics, service requirements, and other relevant factors

- Diversify your procurement portfolio to strategically leverage dedicated, contract, and dynamic capacity

- Become comfortable with dynamic pricing for infrequent and low-frequency lanes

- Establish API connectivity with select transportation companies to procure capacity on hard-to-fill lanes

Technology and data are only valuable when actionable. Partnering with the right provider transforms data into robust market intelligence for use in improving performance. Level up your tech stack with data analytics now to ensure supply chain resilience in 2024 and beyond.

To learn more, visit https://connect.dat.com/Empower_iQ.