2021 was full of supply chain disruptions. From natural disasters and ransomware attacks to ships stuck at sea and a global pandemic that just won’t go away, the supply chain industry went from being upended to somewhat mended to now trying to overcome bottlenecks amid a workforce shortage.

But, it’s important to understand that supply chain disruptions will always occur, pandemic or not, just in different ways, forms and times.

In Food Logistics’ Jan/Feb 2022 issue, editor-in-chief Marina Mayer talks with several industry experts about how to mitigate supply chain threats for tomorrow and beyond.

Here’s an interview with Xinnan Li, VP, RaboResearch F&A supply chains, Rabobank, who details why getting rid of the “black box” in your supply chain allows for more accurate forecasting and advanced planning, with excerpts publishing in Food Logistics’ Jan/Feb 2022 issue. [CLICK HERE to read the article in full].

Food Logistics: 2021 was full of supply chain disruptions, i.e., natural disasters, global pandemic, ransomware attacks, ships stuck at sea and more. Heading into the New Year, what are some other disruptions you see posing threats to our nation’s cold food and beverage supply chains? And, why?

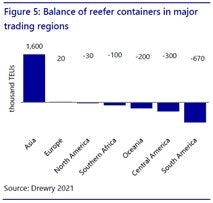

Xinnan Li: In addition to the continued congestion of containers at ports, the imbalanced distribution of refrigerated containers (reefers) will likely loom over the global fresh and frozen food trade in 2022. Major exporting regions such as South and Central America are in large deficits of reefers.

“The gigantic surplus of reefer containers in Asia (1.6m TEUs as of August 2021) is contrasting the huge deficit in Central and South America (-970,000 TEUs). To put things in perspective: Drewry estimates the total number of reefer containers just shy of 3.5m TEUs in 2021. This means one in two containers is now stuck in Asia.” (quoted directly from report)

We expect reefer rates, which have only experienced mild growth so far, to continue to go up and food exporters may have to scramble for reefer capacity in the face of the upcoming export season. On top of this, geopolitical tensions will continue to be threats to the global food and ag supply chain; political decisions may impact food trade directly and indirectly.

In 2022, we also expect labor constraints to continue to challenge the entire industry, impacting each stage of the food industry, from food processing to food transportation and storage.

Food Logistics: How do the supply chain disruptions of 2020 and 2021 differ (or are similar) from what to expect in 2022?

Li: The supply chain disruptions of 2020 were mainly due to pandemic-related lockdowns, temporary manufacturing closures and ocean vessel cancellations on a global scale. Product flow was significantly impacted in 2020. In 2021, we see disruption in terms of container congestion and rate surges, which are mainly a result of a sharp increase in consumer demand. Despite of the frequently discussed supply chain challenges, U.S. containerized imports achieved double-digit surge in the first 10 months of 2021 while containerized exports experienced mild decline compared to pre-pandemic times.

Reefers held up relatively well in both years. Labor shortages also became more prominent in 2021 as consumer demand recovered faster than our workforce. We expect a continuation of the current events into 2022, with labor shortage persisting and container congestion and pricing to normalize in the next 6-12 months. We expect reefer imbalances and trucker shortages to worsen, driving up rates and impacting both domestic food distribution and international food trade.

Rabobank

Rabobank

Food Logistics: What are some things the cold food and beverage industry can do right now to mitigate supply chain threats throughout the chain? I.e., Implement technology, etc. Please be specific.

Li: Increasing supply chain visibility is a top priority with technology and digitalization solutions. Getting rid of the “black box” within your supply chain allows more accurate forecasting and advanced planning. It is important to take a proactive approach rather than a reactive one and this requires participation up and down your supply chain. With better planning, it may also be beneficial to secure larger volumes or longer contracts as those volumes will be fulfilled as a priority. Data also suggests a widening gap between contract and spot container rates for example. And lastly, be flexible between various suppliers, customers, or channels. Pandemic has shown us how consumer consumption can dramatically shift from food service to retail overnight, yet our supply chain is not set up and optimized for it. This exposed opportunities to improve the resiliency of our food supply chain in the face of disruption.

[CLICK HERE to read the article in full].