The high complexity of mobile robots has not stopped growth since 1960, long before the outbreak of the Coronavirus disease (COVID-19). The great variety of applications, sizes, machines and technologies can outline the extent of this complexity. Businesses are then drawn to the flexibility, diversity as well as the easy programming and implementation of mobile robots.

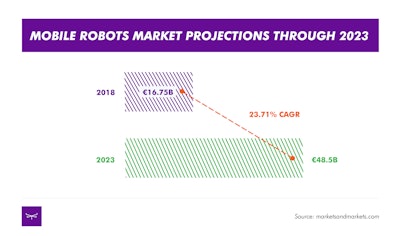

According to MarketsandMarkets, the mobile robotics market value is projected to grow almost 200%, reaching $54.1 billion in 2023. The compound annual growth rate (CAGR) over the forecast period 2018 - 2023 is estimated to be 23.71%.

Before COVID-19, the use of mobile robots in public were rather a novelty than a consistent, visible or preferable choice to most consumers. But, with the onset of this pandemic, autonomous mobile robots (AMR) and autonomic guided vehicles (AGVs) are playing critical roles in many activities across industries around the world.

The social and economic impact of the COVID-19 pandemic

The COVID-19 outbreak has become a global stress test. As the number of suspected and confirmed COVID-19 cases continues to rise sharply, uncertainties regarding the world economic growth increase. As of June 29, the outbreak of the Coronavirus disease has spread to six continents, claiming more than 500,000 lives across the globe. Almost one-fifth of those deaths occurred in the United States.

As many countries around the world have imposed travel restrictions as well as implemented lockdown measures, business activity has been frozen in many sectors, while inequality has been widened and education has been disrupted; as a result, undermining confidence in the future.

The OECD, Dansk Industri, Dansk Erhverv, Danske Bank, and Copenhagen Economics calculated that roughly 27% of all economic activity in the Euro area was dropped due to COVID-19, while activities in the art, entertainment and recreation industry reduced more than 80%.

As a result, the Euro area’s gross domestic product (GDP) is threatened to drop at least 9.1%, meanwhile in America, the country’s GDP is projected to plummet by 7.3%. The situation will be much worse, if there is a second wave of infections before the end of 2020. Though, with or without a second outbreak, the consequences will still be severe and long-lasting.

According to the OECD, the U.S. unemployment rate reached a record high in April, with being 14.7%, increasing 11% compared to 2019’s statistics. Meanwhile, workers in the leisure and hospitality industry suffered the highest unemployment rate of any industry at 39.3 percent as of April 2020. Even though the national unemployment dropped to 13.3% in May, it still shows an alarming sign of the socioeconomic crisis we are facing.

Mobile robotics and market adaptations after COVID-19

Lockdown measures have driven consumers indoor and online. The number of unique digital shoppers have been reported to increase more than 40% year-over-year, while driving 20% revenue growth in 2020 Q1 — 7% higher than the same period last year.

The current circumstances are forcing overloaded organizations — such as retailers, manufacturers and supply chain companies — to evaluate and implement new ways of doing business. As a result, mobile robots have started to gain attention due to their efficiency and capacities to meet the demands, while reducing direct human contact for social distancing.

According to new analysis from Meili Robots, the biggest challenge in the coming weeks was to have enough staff to run the full production lines in factories.

Furthermore, as robots can make up for human vulnerabilities, consumers seem to have a better understanding of the use of robots.

Consumers are getting familiar with the sight of robots running on the sidewalks delivering goods or assisting grocery stores.

As adoption of mobile robots continues to grow, demand for robots hardware — like active binocular 3D cameras and fish eye cameras, ultrasonic sensors and software such as fleet management solutions and cloud services also rises. According to a study from the International Data Corp., worldwide spending on robotics systems is forecasted to reach $112.4 billion by the end of 2020.