Bloomberg recently reported that meat consumption per capita was at its highest level since 2004. The implications being: first, there has never been a better time to be in the meat business, and second, while plant-based meats are growing in popularity, this trend doesn’t appear to be making any impact on the traditional meat business. However, those implications unchallenged could lead to a massively costly capital expenditure, poor marketing decisions by executives, and terrible investment decisions by boards and investors.

Digging into the numbers, you see a few common traps when it comes to interpreting statistics like “all-time high” and how three different tools can actually help you improve your vision, see the truth and make vastly better bets. Specifically, you need a microscope to dig deeper, a telescope for a wide-angle lens and a mirror to bring in emotion and consumer experience.

Applying these three lenses help us uncover the truth behind the recent highs in meat consumption at 222 pounds per capita per year. Looking deeper via the microscope, we see several problems with this claim. First, this number is how much meat was produced, not what was consumed. The number is inflated by exports, which rose from 2 percent of beef in 2004 to 10 percent in 2015. Factoring out exports, meat consumption per capita is actually lower than 2004, so the core premise is incorrect.

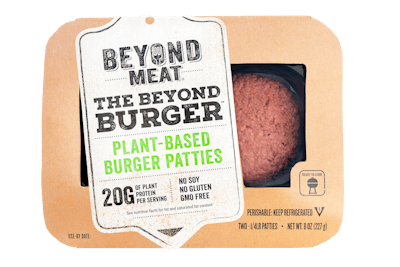

But the real issue is when you step back and use the wide-angle lens separately for chicken and beef you see a tale of two cities. Chicken consumption per capita has risen for four decades from about 50 pounds per capita to over 90 now, while beef per capita has declined from 90 pounds to the mid-50s. And here’s the real ah-ha; the truly disruptive plant-based meats like Impossible Meats and Beyond Meat are not focused on chicken, but are fundamentally aiming to replicate beef, particularly ground beef.

Ground beef is very much at risk of disruption. One might imagine it’s hard to replicate a steakhouse quality filet mignon—but how about a burger? How about meatballs? Both are beef items that many consumers eat loaded up with sauces, condiments and toppings. Plant-based innovators have gotten really close on texture and moisture to ground beef.

Here is where the third lens, a mirror, is critical. Do Americans love meat? Yes. Do they love beef? Absolutely. Do they love ground beef? This is where the answer becomes dubious. If Americans truly loved ground beef, there would be ground beef houses, just like there are steakhouses. The truth of the matter is Americans love the versatility of ground beef. You can buy it once a week and make multiple meals out of it—from spaghetti, burgers, tacos and so on. But they do not love ground beef in and of itself. The taste of ground beef alone does not generate passionate demand from consumers. It is convenient, yet the packaging does not remove the “ick” factor some have when handling meat.

This makes the ground beef market truly ripe for disruption. Plant-based ground beef alternatives can likely compete on taste with ground beef. What happens if they make major upgrades to the packaging to not only solve for the ick factor, but also make it safer to ship via e-commerce? What happens to grocery trips when meat can be delivered and maybe subscriptionized like Netflix? What happens when meal kit companies realize that their offerings may be too high-end for middle class consumers, and they would be better off tailoring their menus to appeal to how most American children eat?

In this context, I would be willing to bet on the likelihood that plant-based burgers, meatballs, meatloaf and tacos are ready to pose a major disruption to the ground beef industry.