The proposed merger between Dutch-owned Ahold and Belgium-based Delhaize would create a major force in the U.S. grocery landscape, according to Ortec Consulting Group based in Atlanta, Ga. The consultancy recently did an analysis on the merger. Following is the analysis.

A merger between Ahold and Delhaize would be considered a new milestone in a retail sector that has been consolidating since the 1980s. There has been a lot of buzz about this possible fusion lately. On the one hand, analysts estimate that the benefits range from $500 million to $1 billion and on the other hand, there are the labor unions worrying about reorganizations and job losses. Ahold and Delhaize both have the lion’s share of their activities in the U.S. so ORTEC looked at publicly available data and compared both companies’ U.S. operations to determine what the merger could mean in the U.S. retail market - the largest and most innovative in the world.

"Ahold and Delhaize are highly complementary and a merger would likely generate benefits for both companies," stated Goos Kant, Ph.D, ORTEC board member and retail industry expert. "Our team conducted a thorough analysis of data from ING, Rabobank and other public sources indicating a merger would be a clear win/win."

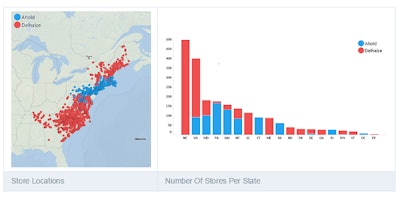

Geographically, Ahold and Delhaize complement each other perfectly. Both are active exclusively in the East Coast. In states where Ahold stores like Giant and Stop & Shop are present (namely Pennsylvania, Connecticut, Massachusetts), Delhaize is hardly present. In states where Delhaize is present with Food Lion and Hannaford, Ahold is barely active. With a merger, they would cover the entire East Coast.

By combining publicly available census data with store locations, we have gained various demographic insights. These maps show that Ahold is mainly present in urban areas with a high population density and a higher real income per capital, while Delhaize is mostly present in areas with a lower income and lower population density.

In states where Ahold operates (70.6 million inhabitants), a person lives at an average distance of 15 miles from one of the company’s stores. On the whole, in all states where Delhaize operates (95 million inhabitants), a person lives at an average distance of 32 miles from a Delhaize establishment. If the companies merge, a person living in one of these states would live at an average distance of 15 miles from an Ahold or Delhaize store. This would be great for business. Together, the companies would cover 109 million people. In other words, over a third of the entire U.S. population would live in states where on average, an Ahold-Delhaize store is located within 15 miles. Population coverage refers to the amount of people living in a radius around a store. This radius is relative to population density. In denser populated areas the range is smaller than in urban areas. Ahold is located in states that are more densely populated. In states where both retailers are active, Ahold also has a higher average population coverage per store.

By combining the store population coverage and the number of stores, the total population coverage can be calculated. Ahold currently covers approximately 61 percent of the total population that both companies would cover when merged. As expected, Ahold reaches more people with less shops.

Aside from operating traditional stores, Ahold owns a very successful online grocery: Peapod. Peapod works with several Ahold brands in the US: Stop & Shop, Giant Food Stores and Giant Food. After a merger with Delhaize, Peapod would have access to the Delhaize network and potentially 1300 new pick-up points that have the benefit of being located in less populated areas - a great advantage for an online grocer.

To conclude, Ahold and Delhaize are highly complementary. Ahold has a larger footprint in urban areas, while Delhaize has its presence in rural areas. Considering the amount of stores, Delhaize is the larger party. Looking at financial figures, Ahold has the upper hand. Since both companies are operating different brands and formulas in mostly different regions, in the early stages of the intended merger, benefits will be mainly found outside the supply chain. Other benefits of a possible merger are:

- Higher purchasing power;

- Product line integration;

- The application of best practices in store operations. Since Ahold has both a larger turnover per employee as per store and seems to be geographically better positioned, there are best practices to share.

- Increased reach - both players would reach 1/3 of the American market with good accessibility for the consumer,

- Expanding Peapod’s reach, both in number and spread of pick-up points but after integration of assortment.

- A merger would turn Ahold and Delhaize into a very strong player in the US retail market, and particularly on the East Coast. This would constitute a major change for a business with foreign roots in the fast-paced American market.

Ahold and Delhaize Snapshot

|

Ahold |

|

Delhaize |

|

768 |

Number of stores |

1295 |

|

11 |

Number of states |

15 |

|

$22,040,756,995 |

Revenue 2014 |

$15,101,812,330 |

|

$28,699,250 |

Revenue per Store |

$11,662,388 |

|

114,000 |

Employees |

96,696 |

|

$193,335 |

Revenue per Employee |

$156,181 |

For more information, contact: http://www.ortec-consulting.com/Topics/how-a-merger-between-ahold-and-delhaize-could-transform-the-us-retail-landscape/