Spot truckload rates for van and refrigerated freight hit their highest national averages since January during the week ending June 23 despite lower load-to-truck ratios, said DAT Solutions, which operates the industry’s largest load board network.

The number of truck posts on the DAT network of load boards increased 3.5 percent while the number of loads declined 2 percent compared to the previous week.

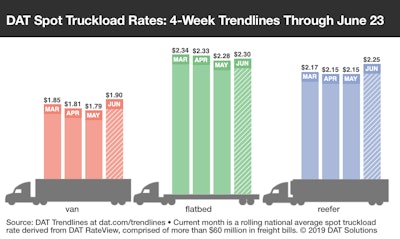

National Average Spot Rates for the Month, Through June 23

- Van: $1.90/mile, 11 cents above the May average

- Reefer: $2.25/mile, 10 cents higher

- Flatbed: $2.30/mile, 2 cents higher

VAN TRENDS

The national average van load-to-truck ratio fell from 3.0 to 2.6 although freight availability on the Top 100 van lanes on DAT RateView remained solid last week. Combined volume on these lanes is up 22 percent compared to the same period a year ago, although spot rates are lower year over year: indeed, the spread between truckload contract rates and spot rates is near a historic high.

Where van rates are rising: The average spot van rate strengthened out of Los Angeles ($2.35/mile, up 5 cents) and Stockton, Calif. ($2.06/mile, up 5 cents), compared to the previous week but volumes were softer, perhaps signaling a winding down of supply chain managers moving freight to beat potential tariff increases. Key van-lane rates on the spot market:

- Stockton to Seattle, up 16 cents to $2.79/mile

- Los Angeles to Phoenix, up 11 cents to $2.80/mile

- Atlanta to Miami, up 12 cents to $2.65/mile

FLATBED TRENDS

Spot flatbed freight volumes increased 3 percent last week and, at 19.0, the national average flatbed load-to-truck ratio was marginally higher compared to the previous week.

Where rates are rising: Raleigh, N.C., stands out for having gained 11.6 percent in the average outbound rate during the last month and hitting $2.94/mile last week. Outbound flatbed volumes were up 41 percent there as well.

In Las Vegas, flatbed volumes surged 51 percent last week and several key lanes saw rates jump:

- Las Vegas to Sacramento, up 55 cents to $2.92/mile

- Las Vegas to Phoenix, up 44 cents to $3.15/mile

- Las Vegas to Los Angeles, up 30 cents to $2.91/mile

DAT Trendlines is a weekly snapshot of month-to-date national average rates from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $60 billion in freight payments. DAT load boards average 1.2 million load posts searched per business day.