When the Coronavirus disease (COVID-19) hit, nearly every facet of the food chain turned upside down. And, now nearly eight months later, the aftermath is a domino effect of supply chain disruptions.

“As the COVID-19 pandemic has evolved, the unlikely ‘real’ challenge of getting food and products where industry and ultimately the consumer needs it most raises many questions about the risks to global supply chains presented by the slowing of transport channels,” says Kimberly Coffin, supply chain director for Lloyd’s Register. “As China began shutting down in February, the absence of available truck drivers either due to illness or isolation led to an inability to unload containers of fresh/frozen foods. As those container numbers began to build, so did a shortage of electric connections to run critical temperature controls and maintain cold chain, thus presenting risk to the perishable foods awaiting delivery to consumers. Likewise, the slashing of international passenger flights has reduced available cargo space on aircraft, leaving global supply chains with significantly fewer options for expediting critical raw materials and highly perishable foods between countries.”

The COVID-19 pandemic could give rise to the next biggest case of food fraud since the 2013 horse meat scandal, if correct protocol levels continue to drop, according to Lloyd's Register.Lloyd's Register

The COVID-19 pandemic could give rise to the next biggest case of food fraud since the 2013 horse meat scandal, if correct protocol levels continue to drop, according to Lloyd's Register.Lloyd's Register

“In a developed world where consumers expect ‘seasonal’ produce to be available in our supermarkets all year long and events of raw material shortage due to production demand change – albeit costly– can be fixed through expedited ‘air’ shipments within 24 hours, the acceptance of the new reality has been a wake-up call for many,” she adds. “And, what of the raw materials and finished products that become stuck in transit due to decreased access to normal shipping channels, port slowdowns, tighter border checks and an absence of truck and lorry drivers? The obvious answer is waste. Think of farmers mulching in harvested produce and dumping milk, unplanned production downtime in the manufacturing sector and the continued limited re-opening of the foodservice sector.”

But, what didn’t falter was the urgency in mitigating risk along the line. That’s because ensuring food safety and quality control have been – and will continue to be – at the forefront of every company’s plan of action.

For instance, several companies took a great deal of measures to implement procedures and standards that elevated food safety and quality assurance.

In July, the Federal Drug Administration (FDA) launched the New Era of Smarter Food Safety Blueprint to help “ensure food safety and prevent foodborne illnesses through the use of science and risk-based standards.” The blueprint focuses on enhanced traceability, smarter tools, new business models for the production and delivery of food and a new culture of food safety.

For its part, AIB International launched the Pandemic Prepared Certification, what is said to be the first certification standard created for the food and beverage supply chain that elevates critical planning for people, facilities and production inputs and delivers significant social impacts, builds bottom line resiliency and unlocks insurance benefits.

“We developed the Pandemic Prepared Certification because the food and beverage supply chain were ill-prepared for a global pandemic and the associated disruption it created in nearly every aspect of business operations worldwide,” says Steve Robert, global vice president of sales, marketing and innovation, AIB International. “The AIB International Pandemic Prepared Certification is a proactive measure to help companies across the supply chain prepare for the future with the only best-in-class protocol benchmark.”

This prescriptive and practical certification provides the food and beverage supply chain with pandemic crisis management, supply chain management, intermittent operations planning management, health crisis mitigation measures and management and pre-requisite program review.

“During the pandemic, supply chains for some ingredients and products have been disrupted. The resulting shortage opens more opportunities to gain profits in any way possible, including the heightened risk of food fraud. This can include any of the seven types of fraud, such as substitutions, dilutions or counterfeiting. Mitigation strategies to ensure accountability of the supply chain are vital,” adds Allie Sequera-Denyko, quality manager, North America, AIB International. “Our Pandemic Prepared Certification is a proactive measure to help companies across the supply chain prepare for the future with the only best-in-class protocol benchmark. Once certified, it provides assurance for the food and beverage supply chain and consumers that your company is committed to establishing and maintaining best practices.”

AIB International also offers virtual Food Fraud: Risk Assessment and Mitigation seminars and various online and virtual food defenses courses to help operations raise their standard for food safety, while reducing risk.

The Federal Motor Carrier Safety Administration (FMCSA) rolled out a finalized rule for enhanced trucking hours of service flexibilities and suspended hours-of-service rules for qualifying deliveries to moderate available trucking capacity and ensure the safe, timely movement of goods during a time of national need.

And, the Consumer Brands Association (CBA) brought together 23 consumer packaged goods (CPG) companies and retailers to launch the Contactless Delivery Task Force to develop scalable, uniform standards for safely transporting and exchanging freight. Transferring from a paper delivery verification system to a digital platform provides safety, productivity and visibility benefits to every employee involved in bringing a product from a manufacturer’s warehouse to the store shelf.

“COVID-19 challenged CPG companies to keep their supply chains moving efficiently and their workers healthy in a tremendously difficult environment,” Tom Madrecki, vice president, supply chain and logistics for CBA, said in a press release. “As CPG companies identify ways to increase supply chain efficiencies and ensure employee safety, electronic delivery verification through a contactless pick-up and delivery process is a natural solution.”

Aside from the many movements and procedures implemented to shore up risk and control, the COVID-19 pandemic still presented a host of risk/security challenges to today’s cold food chains. That’s because risk mitigation is more than just enforcing food safety. It’s about protecting the manufacturing lines and gaining visibility into every step of the cold chain. And, to mitigate risk effectively takes more than just enforcing procedures.

In fact, the effects of the COVID-19 pandemic could give rise to the next biggest case of food fraud since the 2013 horse meat scandal, if correct protocol levels continue to drop, according to Lloyd’s Register.

For instance, businesses should ensure they are using suppliers that have been verified according to international standards.

“Using local sources also provide benefit to the ‘home’ economy and should product failure occur the ability to act swiftly to investigate and implement control more accessible,” says Coffin.

It’s also beneficial to identify, test and verify alternative logistics providers to ensure their routes don’t present added risk to traceability or cold chain compliance for perishable foods.

“Increasingly we are seeing global food retailers using food delivery platforms designed for home delivery of restaurant meals,” adds Coffin. “Although this seemingly provides a quick pivot and ability to increase distribution volume, the question remains regarding how well critical food safety factors in relation to hygiene and cold chain management are understood and applied to ensure risks to product integrity are being effectively managed.”

Other challenges stemming from the COVID-19 pandemic were related to the sudden shift in demand for fresh produce.

“Retail sales were instantly up 20-25% on fresh produce and down significantly on floral. In foodservice, demand dropped by 75%. Online, direct-to-consumer shipments were up by 300-400%. The risk was in the execution. If we were not able to respond quickly to the change in demand, people would have gone without fresh fruits and vegetables,” says Ed Treacy, vice president, supply chain and sustainability for Produce Marketing Association. “Our industry did a tremendous job in shifting the total supply chain to ensure the product was where it was now needed. Forecasting demand for shipments of produce and floral was difficult, forecasting the growers’ planting schedules was extremely difficult with little or no historical data to base the forecast on. The fresh produce industry came together very quickly to ensure that the shift in demand did not result in people not being able to purchase fresh produce.”

On the manufacturing and design-build side of the business, some companies were challenged simply due to the health of employees.

“The supply chain is human based—truck drivers, forklift operators, etc. Humans are a critical element and need to be protected to prevent disruptions,” says Pablo Coronel, director of food processing for CRB. “In the cold food chain, resiliency and ability to adapt for the needs of the consumers is critical.”

One of the bigger problems cold supply chains face is a shortage of human capital, according to Niranjan Kulkarni, director of operations improvement for CRB.

“Food and beverage supply chains rely heavily on human involvement. Production operators, delivery truck drivers, agricultural workers, meat processing employees, etc., all are needed to run operations, but because their presence is required, they have an increased chance of exposure to the COVID-19 virus,” Kulkarni adds. “An increase in operator absenteeism due to actual infections, childcare issues associated with daycare and school closures or even fear of contracting the disease has a severe impact on production and transportation capabilities.”

What’s more is, because of COVID-19, the FDA temporarily discontinued on-site audits for, forcing cold food processors, growers and packers to enforce food safety in other ways.

“The biggest change we have seen since the start of the pandemic is that cleaning and sanitizing has dramatically increased at all levels of the supply chain,” says Sequera-Denyko. “Beginning in late July, FDA resumed on-site inspections, so it is important for operations to assess their plans and practices to ensure that nothing has lapsed in the past few months.

Traditional face-to-face, on-site audits provide the optimum environment for assessment of the food supply chain’s continuing compliance of operational activities and food safety controls from farm to fork, adds Coffin.

“From a remote desktop, independent assessment of critical evidence, e.g. supply and operational monitoring records, product test results, staff training status and internal audits by a qualified auditor bares no difference to the activities that the form the starting point for on-site food safety audits,” she adds. “The question of assessment quality of site conditions, personnel practices, GMP compliance, via virtual/remote audits is one that has gained much scrutiny and, in some instances and direct opposition to the use of technology. Through our experience, using livestream video technology on farm and in factories, we have been pleased that many of the expected compromises were not apparent and high-quality audit outcomes, including the identification of non-conformities, achievable. In some respect, the ability to capture evidence of both good and poor practices through image capture and immediate discussion with auditee proved to enhance the audit process and final reporting.”

Furthermore, FDA’s Food Safety Modernization Act (FSMA) was implemented as a risk-based approach to food safety to help in extreme situations like the pandemic, says Coronel.

“All processors must have food safety plans, which are developed to mitigate any possible risks. As such, the application and enforcement of these plans provides a good measure of safety in current times when the FDA isn’t doing on-site audits.”

Technology tackles food fraud

When it comes to mitigating risk, improving traceability and even monitoring farm to fork along the cold chain, there are an array of technologies that come into play.

“As you look at digitizing and automating your supply chain, there is opportunity for distributed ledger or blockchain technologies to help access data very quickly; it will let us know exactly who has it, where it is or who has touched the product,” says Angela Fernandez, vice president of community engagement at GS1 US. “RFID is another technology being utilized in a way that users can get automatic visibility without having to physically go to the item. We’re seeing that inside of distribution centers as well as back-of-house operations, whether you’re talking about retail or foodservice, we also see the use of sensor technologies being driven as another technology that informs and provides analytics into the overall view of the supply chain operation.”

“We’re seeing this trend happen because it’s in that mindset of understanding full visibility, from farm to fork,” she adds. “If I’m able to monitor and have real-time visibility around the movement of the product, it also enables me to be more proactive than reactive, should something happen that we didn’t anticipate on, like the pandemic and needing to divert and re-route product. Is the condition suitable? How much time do I have left on it? Where is it exactly?”

In fact, blockchain is one of the leading technologies for improving visibility and traceability in cold food chains, says Paul Chang, worldwide blockchain lead for distribution and industrial markets for IBM Blockchain.

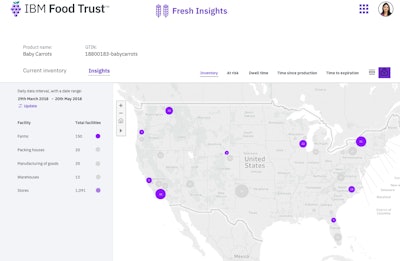

Sharing data on blockchain networks like IBM Food Trust creates end-to-end visibility along the supply chain.IBM

Sharing data on blockchain networks like IBM Food Trust creates end-to-end visibility along the supply chain.IBM

“Companies that are sharing data on blockchain networks like IBM Food Trust can create end-to-end visibility into where their product came from and where it ended up, which has numerous advantages. For example, during a foodborne illness outbreak, grocers can identify which batches of produce came from farms that were impacted within seconds, so they don’t have to waste inventory that is still safe. Sensors can collect temperature data, so that retailers and consumers further downstream in the supply chain can know reliably how long food will be fresh because this information has been recorded on an immutable blockchain. Using other technologies like AI, we study the data being recorded on blockchain and make better predictions about things like demand and shelf life,” Change says. “The COVID-19 pandemic caused a massive shift in consumer behavior. But, the problem wasn’t necessarily that the pandemic reduced the amount of food in cold supply chains; it was that the supply chains weren’t agile enough to adapt to disruptions quickly enough.”

Additional technologies revolve around “smart” packaging, which proves product integrity in respect to product transport and handling conditions across the supply chain via visual representation such as a color change label or QR codes.

“Whilst this does not necessarily provide the real-time data of product assurance and intervention, it does allow for removal from supply at the retail/consumer level,” says Coffin. “Additionally, remote verification via electronic checklists/monitors, using common handheld devices such as smartphones and apps, can provide added assurance for organizations looking for increased confidence that the expected transport conditions and routine checks are being completed as required. Furthermore, the use of this verification technology can be expanded to manage and mitigate other risks related to logistics and product movement, but not unique to the cold chain such as product authenticity and product security. This simple technology not only moves food safety/product integrity checks into a ‘digital’ framework, but also provides for real-time notification if an expected check is out of compliance and/or not completed.”

Likewise, routine activities should include “horizon scanning.”

“An example of increasing risk of fraud could be the situation we are in with the pandemic, which has created additional opportunities and incentive for fraudulent activities,” says Sequera-Denyko. “As you scan the horizon, are you prepared for the next pandemic or other potential disruption to your supply chain?”

Other technologies that proved to be beneficial were transport management systems and truck routing systems.

“There were a lot of trucks redirected on a moments’ notice and delivery plans had to be constantly updated, as the retailers and wholesalers distribution centers were initially struggling to get the trucks unloaded due to the sudden unplanned spike in demand,” says Treacy.

Technology aside, how can companies better identify risks in the supply chain?

“Companies can review what worked and what could have worked better during the first few weeks of the pandemic,” adds Treacy. “We saw some partnerships form very quickly between companies that needed and those who had capacity in labor, transportation equipment, material handling equipment and refrigerated warehouse space. There can be lessons learned from how that was implemented. We saw foodservice distributors providing product, service, equipment, labor and warehouse space to retailers who needed it.”

Future for risk mitigation

The challenge with planning for the future is that no one knows what that future looks like. The post-COVID-19 environment will continue to test supply chains’ resiliency. It will continue to force the industry to revamp processes, procedures and technologies to move cold food and beverages through the chain in a safe, timely and efficient manner.

But, regardless of what the future holds, companies will still need to continue mitigating risk.

“The hard question is how do we recover? How do we get back to normal? What does the New Normal look like? I mean, these are questions we all have,” says Fernandez. “And, on top of that, quite honestly, we’re all kind of bracing for the second wave that hasn’t come yet. We’re still in a state of uncertainty. [The future is] about supply chain resilience, getting back to the agility that you have in your operations to move with the changes that we see in demand and being able to adequately anticipate for the changes we know are coming. So, let’s make things less manual. We have to look at automation because digital is here today. This is how we as consumers are purchasing our cold chain food items today and will for the foreseeable future. And, making sure that we’re able to optimize our shipments and be able to divert them as we continue to see changes in demand through this pandemic.”

“While it is hard to look at investments while we’re just trying to get our companies online at a level that they would be, I would recommend that we don’t omit to that view,” she adds. “Because I think as we look at where we’re headed and the need for digitization, we need to see where we can make those leaps to make those improvements. And, if we have cold chain companies that have not been deploying or minimally deployed some of that sensor technology, that’s probably going to be an area we want to focus on because that is a key part of the equation of some of the pieces.”

The industry can also expect to see increased transparency in food supply chains post-pandemic.

“Transparent supply chains inspire more and are more resistant to disruption because there is a clearer picture of the availability and location of goods,” says Chang. “Retailers and producers both get more information about their products and use that information to adapt in real time to changes in the market.”

Furthermore, supply chain and production planning functions have moved from being long-term forecasts based on historical demands and consumer buying patterns to being utilized weekly or monthly to assess what products to manufacture, says Coffin.

“With decisions focused not on what to manufacture but ‘how’ to manufacture volumes required using the materials on hand/accessible whilst maintaining productivity and efficiency of operations,” she adds. “Although the panic buying experienced early on has proved to abate and grocery store shelves returned to normal, the continued demands on raw material sources, identification and approval of alternative suppliers as well as just the logistics of getting materials to where they need to be will likely see that decisions about what to manufacture will still rely heavily on the how for some time to come.”