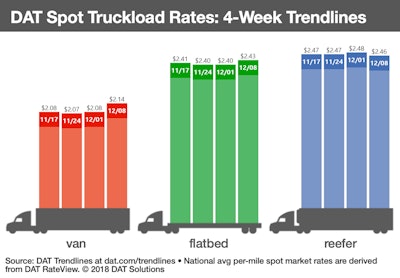

The national average spot van rate increased 6 cents to $2.14/mile during the week ending Dec. 8 although demand for trucks was weaker on high-traffic lanes for retail and e-commerce freight, said DAT Solutions, which operates the DAT network of load boards.

The national average spot refrigerated rate declined 2 cents to $2.46/mile and the spot flatbed rate gained 3 cents to $2.43/mile, the first increase in the national average rate in five months.

Lower fuel prices continue to exert downward pressure on the spot rates, which incorporate a surcharge portion. The national average price of on-highway diesel fell 4.6 cents to $3.16/gallon, its lowest point since the end of April.

Van trends: Momentum stalls on top lanes

The number of van load posts on DAT load boards was down 13 percent last week while truck posts surged 53 percent as truckers returned from the previous holiday week. Looser capacity pushed the load-to-truck ratio down to 5.5 loads per truck compared to 7.2 the previous week.

Despite the higher national average rate, momentum in the spot van market stalled by midweek as freight volumes fell 5.3 percent on the Top 100 lanes. Rates on those lanes slumped as well, with 62 lanes down an average of 1.9 percent, or roughly 4 cents per mile, compared to the previous week. There were large drops in van freight activity in Atlanta, where the number of posted loads fell by 11.3 percent, and Los Angeles, down 8.9 percent, among other van freight hubs.

Absent a rebound this week, the anticipated holiday peak for van freight appears to be muted.

Reefer trends: Outbound rates drop in major markets

Reefer load posts on DAT load boards slipped 16 percent compared to the previous week. Truck posts rose 9 percent, which pushed the national ratio down 23 percent to 6.3 reefer loads per truck.

The average outbound rate took a step down in several key reefer markets, including Grand Rapids, Mich. ($3.34/mile, down 10 cents), Chicago ($2.93/mile, down 14 cents), Philadelphia ($3.19/mile, down 7 cents), and Los Angeles ($3.13/mile, down 13 cents).

Flatbed trends: Load-to-truck ratio slips

Flatbed demand slipped slightly last week after a surge in the previous week. The number of flatbed load posts fell 4 percent while truck posts increased 16 percent compared to the previous week. The national load-to-truck ratio dropped from 23.9 to 19.8 loads per truck.

DAT Trendlines are generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $57 billion in freight payments. DAT load boards average 1 million load posts per business day.