While national average truckload prices held steady during a short Thanksgiving week, spot van rates increased on nearly every major lane in the country, says DAT Solutions, which operates the DAT network of load boards.

Rates on the 100 largest van lanes rose an average of 2.3 percent or 5 cents per mile during the week ending Nov. 24, with 78 lanes moving higher and just 17 declining. The biggest rate increases were on lanes known for e-commerce freight, particularly in the Northeast.

The national average spot rate for refrigerated freight was unchanged while the flatbed rate continued its seasonal decline.

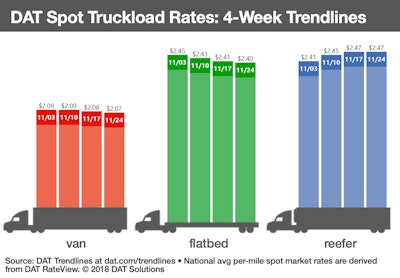

National average spot truckload rates:

- Van: $2.07/mile, down 1 cent compared to the previous week

- Reefer: $2.47/mile, unchanged

- Flatbed: $2.40/mile, down 1 cent

Van trends: Van load posts on DAT load boards declined 12 percent while truck posts fell 28 percent last week, which included the Thanksgiving holiday (a 20 to 25 percent decrease is typical). The national average van load-to-truck ratio was up 21 percent to 6.4 loads per truck.

Pricing in major outbound markets reflected the start of a busy season for van freight, including Buffalo ($2.78/mile, up 19 cents); Charlotte ($2.39/mile, up 9 cents); Atlanta ($2.25/mile, up 5 cents); Houston ($1.84/mile, up 4 cents); Chicago ($2.57/mile, up 9 cents); and Columbus, Ohio ($2.51/mile, up 9 cents).

Among the van lanes with substantially higher prices:

- Buffalo to Allentown: $3.69/mile, up 38 cents

- Columbus to Allentown: $3.37/mile, up 23 cents

- Atlanta to Philadelphia: $2.41/mile, up 30 cents

- Chicago to Detroit: $3.46/mile, up 22 cents

Reefer trends: Reefer load posts on DAT load boards were down 33 percent while truck posts declined 19 percent. That caused the national load-to-truck ratio to drop from 7.5 to 6.2 loads per truck. The national average reefer rate was unchanged.

Regionally, rates from central California dipped, which is to expected with Thanksgiving week not conducive to long-haul freight.

One surprise was a sharp rise in Florida reefer rates, including Lakeland, where the average outbound rate was up 12 cents to $1.64/mile.

Flatbed trends: Flatbed load posts on DAT load boards were down 45 percent during the Thanksgiving holiday week, while truck posts declined 36 percent. That caused the national load-to-truck ratio to drop from 18.5 to 15.9 loads per truck.

DAT Trendlines are generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $57 billion in freight payments.

DAT load boards average 1 million load posts per business day.