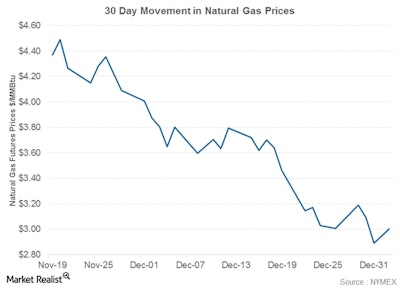

Natural-gas prices are hovering near a three-year low; they are at about one-sixth of the record hit a decade ago, according to The Wall Street Journal. Even when oil prices were rebounding from the low they hit during the 2008-2009 recession, the North American natural-gas market was entering a glut from which it has yet to recover.

A big reason is that gas, unlike oil, isn’t fungible in the same way. In other words, high prices in Asia or Europe mean little since gas export capacity remains largely on the drawing board. Another is that booming oil production in shale formations also produced plenty of gas. Drillers were willing to sell that byproduct at almost any price or just flare it off in many cases.

Nor has plunging oil-exploration activity put a dent in gas production or supply. The Energy Information Administration reported on Thursday that gas in underground storage was near a record for this date of over 3.6 trillion cubic feet, up 14 percent from a year ago.

To read more, click HERE.

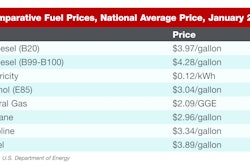

Editors Insight: Economic forecasts put natural gas prices much lower than petroleum-based fuels for the foreseeable future, and they’re less volatile on commodity markets. The fact that such a large amount of natural gas can be produced domestically is a huge incentive for many companies to invest in natural gas fleets.

Natural gas is one of several alternative fuels that can provide lower costs, smaller carbon footprints and reduced emissions. Fleet operators have to consider the upfront costs, including the need to train drivers and maintenance technicians about new technologies. Fleet managers also have to consider the available fueling infrastructure, tax credits and incentives, all of which can vary significantly among geographic regions. 10-9-15 By Elliot Maras