After several weeks, the world continues to watch in horror as the war rages on. As the atrocities mount, countries are finding new ways to respond with punitive sanctions. And, like many things in the web-like global economy, there are downstream impacts and unintended consequences of the necessary decisions made by world leaders.

Unfortunately, consumers can expect to see ongoing extreme variability in pricing and availability of goods, especially within Europe. If Russia goes on the offensive in response to the sanctions by cutting the energy supply, there will be major long-term consequences, even if the war were to end shortly after.

Thankfully, the initial impacts and disruptions have settled as companies have made long-term decisions to source or distribute products and materials through alternative partners or channels. Niche commodities cause concern, but on the whole, companies have been able to keep manufacturing and distribution lines running as needed.

Leading indicators

When the war first broke out, FourKites identified three indicators to watch -- Asia-to-Europe shipments, trucking routes and availability of drivers and the cost of fuel. Since then, the Coronavirus disease (COVID-19) outbreaks and shutdowns in China have made Asian shipments all the more volatile. FourKites data shows that the seven-day average for ocean shipment volume through the Port of Shanghai is down 26% compared to March 12, the day before lockdowns began in Shenzhen and partial lockdowns began in Shanghai.

Meanwhile, diesel prices are up 28% in the United States since the war began and have risen by similar levels worldwide, per the U.S. Energy Information Administration. As expected, the truck driver shortage in Europe is also being made worse by the war.

What the data shows

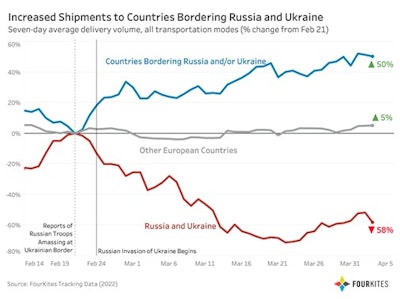

A few trends have emerged as FourKites started tracking the impacts of the Russia-Ukraine conflict each week. Most obviously, imports to Russia and Ukraine have plummeted by 54% and 76%, respectively, compared to pre-war volumes. However, shippers are possibly diverting goods to nearby countries to avoid the conflict, with the seven-day average delivery volume to bordering countries up 50% compared to Feb. 21.

FourKites

FourKites

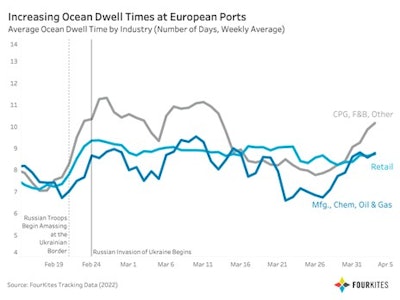

Perhaps the greatest ripple effect has been delays at European ports. Ocean dwell time for European exports is increasing, driven primarily by Northern Europe, where dwell times are up 45% week-over-week and up 40% in total compared to mid-February. Notably, FourKites has seen dwell times for consumer packaged goods (CPG) and food and beverage products increase over the past week, up 35% week-over-week and up 53% in total since mid-February. While these delays create undesirable snags and snarls in global supply chains, their magnitude has not been above and beyond what we see with other disruptions like weather events or COVID-19.

FourKites

FourKites

What’s next

As the war progresses, additional regions and products are being impacted, with increased monitoring of any bullwhip effect that higher dwell times and volatile prices may cause.

And though the threat of banning Russian coal and oil is significant, the proposal to “ban most Russian and Belarusian ships and trucks from entering the bloc” also caught our attention

While it’s hard to predict the future, expect more supply chain chaos for months to come.