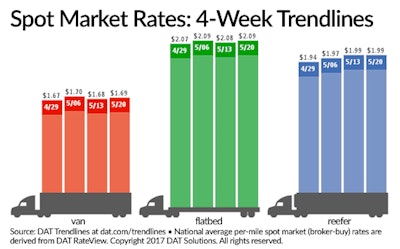

National average spot truckload rates for van and flatbed freight rose during the week ending May 20, while the rate for spot refrigerated freight remained at its highest mark since January, said DAT Solutions, which operates the DAT network of load boards.

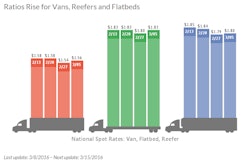

The number of available loads on DAT load boards increased 5.4 percent compared to the previous week, while posted capacity fell 2.9 percent. Van and reefer load-to-truck ratios had double-digit increases:

- Van ratio: 3.7 loads per truck, up 12 percent

- Reefer ratio: 7.2, up 17 percent

- Flatbed ratio: 38.3, up 4 percent

Van Trends

The national average van rate increased 1 cent ($1.69/mile), as the number of posted loads increased 9 percent and truck posts fell 3 percent. Average outbound rates from major markets were mixed:

- Los Angeles: $2.02/mile, up 1 cent

- Chicago: $1.86/mile, down 2 cents

- Houston: $1.77/mile, unchanged

- Charlotte: $1.97/mile, down 2 cents

- Philadelphia: $1.65/mile, down 2 cents

Reefer Trends

Reefer load posts increased 13 percent, while truck posts declined 2 percent last week. The national average spot reefer rate held at $1.99/mile, the highest weekly average since mid-January.

Prices out of California were varied, with rates trending up in Southern California but slipping or remaining unchanged in Central Valley markets. With harvests winding down in Florida, rates dropped significantly from Miami and Lakeland.

Other key reefer lanes:

- McAllen-Dallas: $2.51/mile, down 3 cents

- Elizabeth, N.J.-Boston: $3.46/mile, down 12 cents

- Atlanta-Chicago: $1.57/mile, down 15 cents

- Los Angeles-Denver: $2.87/mile, up 3 cents

- Grand Rapids-Atlanta: $1.92/mile, up 2 cents

Flatbed Trends

There was very little movement in the flatbed trendlines, as load posts increased 1 percent, while truck posts declined 3 percent. The national average spot flatbed rate added 1 cent to $2.09/mil, and at 38.3, the flatbed load-to-truck ratio remains strong.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit dat.com/trendlines, and join the conversation on Twitter with @LoadBoards.