Recent oil markets have not been kind to shippers. Since 2021, the price per barrel for crude oil has averaged $72.50, nearly $20 more than it was in the three years leading up to the pandemic. Food and beverage shippers have likely felt the impact of that extra $20 per barrel more than most.

That’s because food and beverage shippers rely on extensive, often international, upstream supply chains to transport raw ingredients. In most instances, they bear the expense of higher fuel prices multiple times over before incurring the cost of finally transporting products to customers. That’s in addition to widespread pressure to do more with less in the face of inflation, while simultaneously making progress on sustainability goals.

Unfortunately, diesel fuel price relief is unlikely to arrive in 2024 as diesel inventories remain tight and OPEC+ continues to make crude oil production cuts. But the good news is alternative energies offer growing opportunities to ease budget pressure. While the scale of food and beverage logistics networks makes diesel prices particularly impactful, exploring cost-competitive alternative fuels can provide network price stability and reduce emissions.

What to expect from diesel prices in 2024

In 2024, the price point at which the Department of Energy (DOE) purchases crude oil to replenish the Strategic Petroleum Reserve (SPR) will increase by roughly $7 per barrel, or about 10%. Since diesel is refined from crude oil, this adjustment, from about $72-79 per barrel, provides guidance that the diesel price floor will remain elevated during 2024.

The DOE has also canceled plans to sell 140 million barrels from the SPR between 2024-2027. These periodic, congressionally mandated sales would have sent more oil into the market, resulting in downward price pressure. But in an effort to shore up the U.S.’ oil reserves, that lever is locked until at least 2027. Other macroeconomic factors continue to exert influence over diesel fuel prices as well. These include geopolitical conflicts, trade route changes, emissions regulations, and elections and leadership changes in energy-producing countries. The interaction of these market forces likely means uncertainty will persist throughout 2024.

The economic equation for emissions reduction

A recent supply chain sustainability survey from MIT found that due to fears of economic contraction, companies were less willing to increase sustainability resource allocations in 2023. In a down market, sustainability initiatives need to make economic sense and many companies question whether they do.

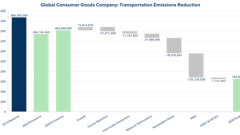

But the math checks out. There are several economic incentives to reduce emissions in the supply chain, especially in the food and beverage industry. Elevated diesel prices are converging with emerging alternative energy infrastructure and regulatory incentives to minimize diesel consumption, presenting opportunities for you to take meaningful steps toward creating more resilient transportation networks.

Polyfuel opportunities for food and beverage transportation networks

Given the overall landscape, it’s time to strategically begin to diversify your fuel sources, adding options like renewable diesel, biodiesel, EVs, and renewable natural gas to the mix. As alternative energy becomes more attractive, infrastructure improves, and capacity expands, your organization can benefit from new opportunities to save on transportation spend.

A polyfuel strategy that supplements conventional diesel with multiple alternative energies enables you to pilot alternative fuels and emerging technologies on a small scale, stacking up incremental progress toward emissions goals.

Consider the following opportunities to mitigate risk from volatile diesel markets and integrate alternative energies into your transportation plan:

● West Coast routes. Alternative fuels are most cost competitive on the West Coast, which often experiences a diesel price premium and more intense price volatility relative to other regions of the United States due to lack of pipeline infrastructure. California, in particular, is at the forefront of creating policies that push for alternative energy and zero-emissions powertrains in heavy-duty freight. This combination of high diesel costs and regulatory incentives means polyfuel options are more available and more affordable. That’s particularly meaningful since California’s high agricultural production and access to shipping routes from Mexico make it a key region for food and beverage transportation.

● Redundant networks. Compared with other sectors, you’re more likely to travel along the same routes at predictable intervals for recurring shipments. These network redundancies ensure alternative energy vehicles will be used consistently, making it easier for carriers to feel comfortable working with you on an alternative energy pilot. As a result, you will likely find it easier to establish mutually beneficial partnerships with carriers that offer alternative energy tractors in their fleets.

● Modular approach. Alternative energy technology is advancing rapidly, which will reduce the cost of deploying these solutions over time. Already, early adopters of commercial battery-electric trucks are achieving a competitive total cost of ownership. Trialing alternative energy solutions on a small scale will leave you more prepared to make them a primary component of your transportation network when availability expands. This experimentation will equip you with the knowledge and experience to capitalize on expanded alternative energy opportunities as the market evolves and new incentives emerge.

Take control of market uncertainty with a polyfuel strategy

The energy industry is growing in complexity as macroeconomic forces continue to influence oil markets. While higher diesel fuel prices are unavoidable, there are still opportunities to uncover cost savings and achieve competitive advantages.

Pursuing a polyfuel strategy now will enable you to minimize transportation costs along repetitive lanes in the short term. And looking ahead, you’ll benefit from a more optimized and efficient network that positions you to expand alternative energy capacity as soon as these fuels become more affordable and widespread.