For the past 3 years, the trucking industry has faced numerous challenges stemming from the onset of COVID-19. However lately, the disruptions have become more… disruptive and less predictive.

Present day, it’s not just a lack of visibility that’s creating bottlenecks along the way; today’s challenges run deep, are more personal and stem from a variety of causes such as the passage of certain laws, the lack of agreements to better protect contract workers and more.

And, sometimes even the most cutting-edge technology can’t predict what’s going to happen next.

Marina Mayer, Editor-in-Chief of Food Logistics and Supply & Demand Chain Executive, talks exclusively with Bart De Muynck, chief industry officer at project44, who details why electrification may not currently be the answer to the sustainability requirement in the short term.

CLICK HERE to read the article in full.

Food Logistics: The California Air Resources Board voted unanimously to finalize its Advanced Clean Fleets rule, which requires all new medium- and heavy-duty vehicles sold or registered in the state of California to be zero-emission come 2036. What does this mean for the future of trucking and transportation?

Bart De Muynck: Companies are increasingly folding sustainability considerations into their business models and regulators are requiring that they do so. Trucking and transportation companies need well-proven sustainability strategies that are easy to implement and fit within the business objectives.

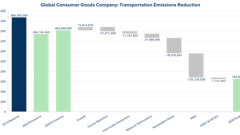

The first step to making an impact on your carbon footprint, which is also much more realistic and feasible in the short term, is understanding just how many greenhouse gases you are emitting. Up to 60% of a company’s emissions are Scope 3 supply chain emissions, originating from assets companies themselves do not directly control. As the industry leader in supply chain visibility, with exclusive GLEC-accredited emissions calculation via partnerships, project44 is uniquely positioned to help shippers and LSPs tackle Scope 3 emissions to create more sustainable supply chains.

For example, proprietary data populates easy-to-use dashboards with historical CO2 carbon footprint intelligence and shipment-level granularity so customers can view emissions information by trade lane, origin, destination, ocean carrier, country, time period, booking and container number. Customers can also identify emissions hot spots and uncover the full fuel lifecycle ‘from well to wheel.’

While these measures and regulations support worthy causes, they do introduce more complexity for supply chain professionals, particularly when it comes to adequately managing capacity. Leaders will need to be armed with accurate data to make informed decisions that will meet regulations and improve efficiency.

Food Logistics: The FMCSA changed its Hours of Service regulations to allow some expansions to the workday. Thoughts on how this helps/hurts the transportation industry?

De Muynck: The expansion of hours should provide more flexibility and increase capacity across sectors of transportation. Labor conditions have been an ongoing concern and because of the crunch in labor, workers have the power to demand commiserate compensation. The ELD mandate effectively created a reduction in actual work time which also led to increased stress levels for drivers. Although improved safety was the top goal of introducing the ELD mandate, the order initially did not help reduce the number of accidents on the road.

Expanding the workday helps the transportation industry in other ways.

It provides increased flexibility for carriers and drivers in managing their schedules. This might be beneficial for some drivers and companies that want more control over their operations, allowing them to better adapt to varying demands and unforeseen circumstances.

It improves productivity as drivers may be able to complete more deliveries or cover longer distances within a single shift, leading to improved service levels and potentially reducing shipping costs.

However, there are two main concerns on how this could possibly hurt the transportation industry. The first relates to driver fatigue. If the changes to the regulations result in extended work hours without adequate rest, it could increase the likelihood of fatigue-related accidents. Safety should always be a paramount concern in the transportation industry. The second concern relates to the health and well-being of drivers as longer work hours may have negative health implications. Extended shifts can lead to increased physical and mental stress, potentially affecting their quality of life. Moreover, if drivers have less time for rest and personal activities, it may contribute to a higher risk of burnout and decreased job satisfaction.

Food Logistics: Electrification in trucking continues to become more prevalent. In fact, the Infrastructure Investment and Jobs Act (IIJA) allocated $7.5 billion to establish long-distance EV traveling and install charging stations near residences or workplaces. What is your take on the future of EVs, and how likely is the supply chain industry in adopting this alternative fuel source?

De Muynck: EV shipping is starting to see more innovation and the delivery of these long-promised trucks are starting to be reality. It’s a major shift from relying on fuel stations to waiting time to charge, especially because it will shift travel times and arrival times for carrier loads. EV trucks are more expensive to purchase which may impact some shipping costs as the transition occurs. In the long term, the industry will need to adapt to align to new regulations for sustainability.

Although many companies are looking into electric vehicles, electrification is currently not the answer to the sustainability requirement in the short term as production of Class 8 EVs and the need for charging infrastructure would not be able to keep up with demand. Cost is also a consideration as many drayage carriers buy third-generation assets with an average cost of $50K. Those carriers would not be able to afford an electric vehicle.

When looking at alternative fuel sources, we have to keep in mind that newer diesel vehicles and clean diesel vehicles are a big improvement in GHG emissions. Other alternative fuels like biofuel or hydrogen could be a better solution for long haul transportation.

Food Logistics: Mobility-as-a-Service (MaaS) is also on the rise. Describe what this means for the cold food chain?

De Muynck: Mobility-as-a-Service (MaaS) can be described as a transportation model that integrates various modes of transport, such as public transit, ridesharing, car rental, and bike sharing, into a single, accessible platform. The main aim of MaaS is to provide its users with seamless and convenient mobility options to meet their transportation needs.

When considering the cold food chain, which involves the transportation and storage of perishable food items at low temperatures, MaaS can have several implications. MaaS can optimize the logistics of the cold food chain by offering real-time data and coordination of different transportation modes. This helps ensure that perishable goods are transported in the most efficient and timely manner, reducing the risk of spoilage or quality degradation. MaaS platforms can leverage advanced algorithms and data analytics to optimize delivery routes for cold food transportation. By considering factors such as traffic conditions, delivery schedules, and temperature requirements, the platform can suggest optimal routes to minimize transit times and maintain the integrity of perishable goods. MaaS can enhance visibility and traceability within the cold food chain. Integrated tracking systems can provide real-time updates on the location and temperature status of shipments, allowing stakeholders to monitor and ensure compliance with temperature requirements. This helps identify and resolve any issues or deviations promptly, in turn helping improve customer experience in the cold food chain.

By providing transparent information on delivery times, real-time tracking, and temperature monitoring, MaaS platforms can instill confidence in customers regarding the quality and safety of the delivered goods.

MaaS can facilitate collaboration and resource sharing among different stakeholders in the cold food chain. For example, businesses in the food industry can partner with MaaS providers to optimize vehicle utilization, share transportation infrastructure, or coordinate deliveries, thereby reducing costs and increasing operational efficiency.

To make MaaS work, companies need to carefully consider regulatory requirements, food safety standards, and the unique challenges associated with maintaining temperature control throughout the transportation process.

Food Logistics: Describe some other trends and challenges in trucking and transportation set to impact the future of cold food chain logistics, the recent I-95 bridge collapse in Philadelphia, the truckers boycott due to passage of Senate Bill 1718, the West Coast port contract negotiations, etc.

De Muynck: We have become accustomed to disruptions in the supply chain these past few years. Most recently, we have seen major impacts caused by weather such as the drought in the Panama Canal or the fires in Canada in addition to the I-95 collapse and West Coast strike. The I-95 collapse specifically highlights the vulnerability of critical infrastructure and the need for robust contingency plans. Investments in preventive measures, such as regular inspections, fire suppression systems, and early warning systems, can help mitigate the impact of such disasters. Companies should be reviewing their transportation plans regularly. They should be armed with real-time, accurate data to quickly identify alternative routes or modes of transportation that can be utilized to bypass the affected area.

It is critical during these disruptions to maintain open communication with suppliers and customers to inform them about potential delays and discuss contingency plans. Collaborate with them through visibility data to adjust delivery schedules, reroute shipments, or explore temporary storage options if necessary. Engage in proactive communication with logistics providers, carriers and third-party logistics (3PL) partners to align strategies and find alternative solutions. Work together to optimize routes, explore consolidation opportunities, or adjust schedules to mitigate delays. In some cases, damages might be recuperated by assessing existing insurance policies to understand coverage related to such supply chain disruptions, delays, or property damage. Engage with insurance providers to ensure adequate protection and explore options for potential claims.

During disruptions, it’s essential to use real-time data to get constant updates on these lead times to notify customers as soon as possible if there will be a change in delivery date. Customers value constant communication and regular updates on transit expectations.

Food Logistics: What are some things not addressed above that may be pertinent to our readers?

De Muynck: Supply chains need to get back in sync in 2023 coming out of the disruptions faced as a result of the pandemic. We will soon see a shift among logistics executives from strictly transactional perspectives to a more strategic and holistic sense of their function’s role.

The top thing trucking companies are seeking is real-time visibility and connectivity to streamline services. The core problems right now in global shipping and logistics are ultimately about order and inventory visibility. What is moving? Where is it moving? What container is it in and how do they reduce risk?

They want continuous, real-time insight into where everything is and its condition. Only innovative technology can provide that visibility decisionmakers need to be proactive as opposed to reactive with their supply chain operations.

CLICK HERE to read the article in full.