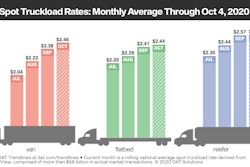

Spot market rates for van and refrigerated (“reefer”) freight soared to all-time highs in September, according to DAT Freight & Analytics, which operates the industry’s largest online marketplace for spot truckload freight. Spot flatbed rates were up from August as well, but were shy of their high-water mark during the middle of 2018.

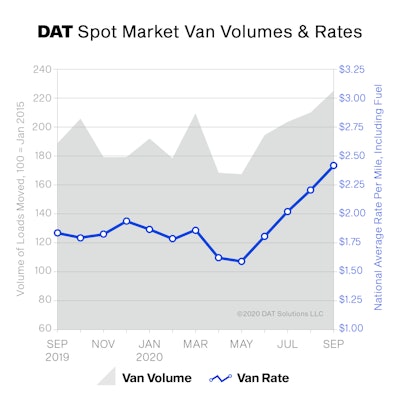

September spot van, reefer and flatbed volumes were similar to August but load-to-truck ratios increased across all three equipment types as available capacity tightened. The DAT Truckload Volume Index, a measure of dry van, reefer and flatbed loads moved by truckload carriers, rose 6.1 percent from last month and was 13 percent higher than September 2019.

“We’re seeing strong volumes across equipment types as the economy continues to recover, particularly in areas related to consumer spending. It’s good news for retail, but the industrial and energy sectors are still seeing a dip in volumes,” said Ken Adamo, Chief of Analytics at DAT. “Spot market rates just keep climbing as companies turn to the spot market to help them manage imbalances in their supply chains.”

Nationally, the September load-to-truck ratio for vans rose for the fifth straight month to 5.5, meaning there were 5.5 available loads for every available truck on the DAT network. The van load-to-truck ratio was 3.8 percent higher compared to August and more double the ratio in September 2019.

Average spot line-haul rate for vans set a new record

The spot van rate averaged $2.37 per mile nationally in September, up 15 cents compared to August, and 53 cents higher compared to September 2019. At $2.18 per mile, the average spot line-haul rate for vans (the total rate minus fuel surcharges) set a new record in back-to-back months as the highest monthly national average ever and exceeded the national monthly average contract rate in consecutive months, which was also a first.

Spot reefer volumes fell for the third month in a row, down 1.3 percent month over month. The national average reefer load-to-truck ratio was 9.7 in September, more than five times higher than April’s record low of 1.7 loads per truck. The national average spot reefer rate was $2.57 per mile, up 13 cents compared to August, and 41 cents higher year-over-year.

The national flatbed load-to-truck ratio averaged 40.3 in September, its highest point since June 2018. September flatbed volumes were up 2.8 percent compared to August but 8 percent lower than September 2019. The national average spot flatbed rate was $2.41 per mile, 11 cents more than August and 22 cents higher than September 2019.

DAT Freight Outlook

- Grocery store chains are adjusting their lean-inventory strategies and have begun stockpiling for a possible surge of COVID-19 cases in the fall and winter.

- The holiday shopping season will look different this year, with major retailers starting earlier and lengthening their deals to accommodate shifting demand from consumers. The holiday season includes Halloween, Thanksgiving, Black Friday, Small Business Saturday, Cyber Monday, Super Saturday and Christmas, all events that typically create higher demand from truckers to haul freight.

- The accelerated inventory build-ups add yet another dimension to an already disjointed freight market, as manufacturers work to avoid the inventory failures seen in March this year.

- DAT’s September FMIC Pulse Signal report, which benchmarks $50 billion in freight transaction data supplied by retailers, manufacturers and other major shippers, forecasts that year-over-year changes in active contract rates will continue to remain below 2019 levels through the end of the year, with average contract rates increasing most likely in Q1/Q2 2021. This depends on a number of factors, including the state of the economic recovery, the election results and the progression of COVID-19.

- According to FMIC, the amount of freight moving on the spot market in August increased by 80 percent year over year.