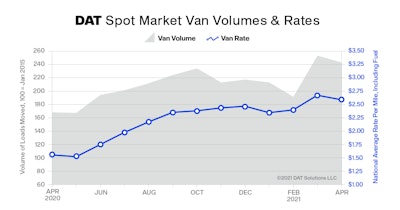

Truckload freight activity dropped in April, though the month was still the second busiest month on record for shippers, freight brokers and motor carriers, according to DAT Freight & Analytics.

In April, the company registered 225 an aggregated measure of dry van, refrigerated (“reefer”) and flatbed loads moved by truckload carriers, down 5% from the high set in March this year.

“It’s not unusual to see a decline from March to April, but truckload freight activity remained at historic levels compared to previous years,” said Ken Adamo, Chief of Analytics at DAT. “The April TVI was 39% higher than it was in April 2020 and April 2018, and 26% higher than in April 2019, indicating unusually strong demand for truckload capacity last month. Trucking companies are in the driver’s seat with respect to pricing power.”

Per DAT:

- The national average spot rate for van loads on the DAT One load board network was 8 cents lower than the March average at $2.59 per mile, but the second-highest monthly average van rate on record.

- The national average spot reefer rate was $2.93 per mile, 2 cents lower than in March, while the spot flatbed rate averaged $2.96 per mile, 18 cents higher month over month.

- Supply chain imbalances due to commodity shortages for manufacturing and the reopening of long-shuttered offices and service businesses have led to increased use of the spot market. In most years, 12 to 15% of truckload freight moves on the spot market; that figure is closer to 25% today.

- During the first week of May, the volume of load posts on DAT One was 36% higher compared to the same period in 2018, when spot truckload freight activity followed a more typical pattern.