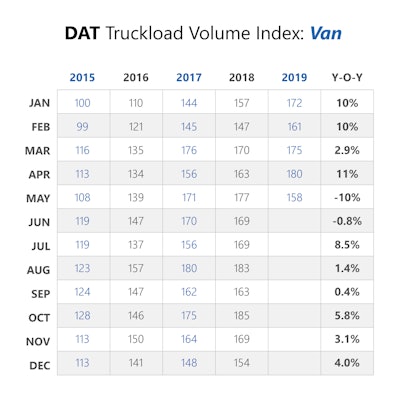

Spot truckload freight volumes failed to meet expectations in May, said DAT Solutions, which operates the largest truckload freight marketplace in North America.

The number of full-truckload van loads moved on the spot market declined 12 percent in May compared to April, according to the DAT Truckload Volume Index. Van load counts were down 10 percent compared to May 2018. Van trailers haul approximately 70 percent of all truckload freight.

DAT

DAT

“Simply put, May was a disappointment in terms of load counts,” says DAT Senior Industry Analyst Mark Montague. “We’re accustomed to seeing higher volumes of retail goods, fresh produce, construction materials, and other seasonal spot truckload freight moving through supply chains at this time of year.”

Trade and Tornadoes

Uncertainty over trade agreements and slumping imports from China seemed to dampen truckload demand. Record rainfalls, flooding, and tornadoes also hampered freight movements in many parts of the country.

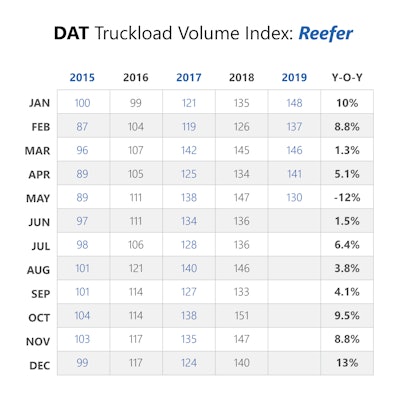

Agriculture producers saw their supply chains disrupted by the weather, with many harvests ruined or delayed. As a result, refrigerated (“reefer”) volumes declined 8.3 percent month over month and fell 12 percent year over year.

Flatbed load volume, which includes heavy machinery and construction material, dropped 9.3 percent month over month and 3.1 percent year over year.

DAT

DAT

Freight Rates Retreat

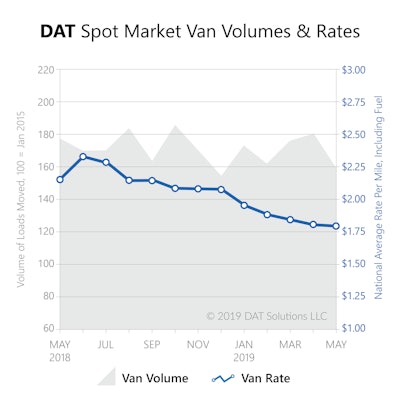

Spot truckload rates continued to track well below last year’s record levels.

Compared to April, the national average spot van rate was virtually unchanged at $1.80 per mile, including a fuel surcharge. That’s 35 cents below the average for May 2018. The average reefer rate was $2.15 per mile, 1 cent higher than April and 38 cents lower than May 2018. The flatbed rate averaged $2.27 per mile, down 5 cents compared to April and 45 cents lower year over year.

“After a lackluster May, June is shaping up to be a pivotal month for trucking,” Montague says. “We will know soon whether the volumes we expected in May were simply delayed. If so, the pent-up demand could boost seasonal volumes at the close of Q2.”

The DAT Truckload Freight Volume Index is based on load counts and per-mile rates recorded in DAT RateView, with an average of 3 million freight moves per month. Spot market information is based on transactions arranged by third-party logistics (3PL) companies, while contract volumes and rates are arranged between shippers and carriers, with no intermediary.