Parsyl, Inc. announced ColdCover by Parsyl Insurance, a suite of connected cargo insurance products for perishable goods powered by its IoT data platform. As the only integrated supply chain visibility and cargo insurance solution, Parsyl has created a data-driven insurance offering that is simple, transparent and fast, including the industry’s first and only parametric spoilage policy, protecting against losses due to temperature. Parsyl’s cargo insurance suite gives shippers of perishable goods the coverage, predictability and protection they need for the largest risks to their products.

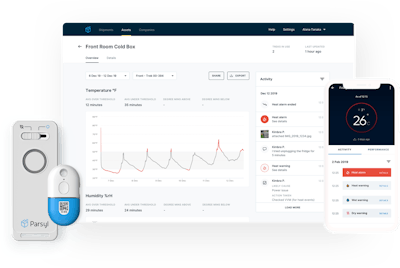

All ColdCover policies include access to Parsyl’s detailed quality monitoring and risk management platform, which combines smart sensors and data analytics to automatically generate interactive shipment visualizations, aggregated performance insights and recommendations for avoiding issues with future shipments. These insights help shippers improve supply chain performance, reduce risk and lower insurance costs.

“This is an outstanding example of how insurtechs and insurers can partner to bring innovation to the cargo insurance market at a time when supply chain interruptions demand new thinking and new products from Lloyd’s,” said Andrew Brooks, CEO of Ascot Group. “The power of Parsyl’s data is what enables them to respond quickly to customer needs, eliminate or reduce adjustment costs, and drive down expense ratios – something that benefits clients and insurers alike. We’re thrilled to be backing this truly unique offering.”

Parsyl is able to assess risk and process claims quickly by using its data to understand exactly what happened to goods at any point in the supply chain. The featured product within the suite, ColdCover Parametric, includes customizable quality triggers and payout levels. Parametric coverage is based on product-specific degradation algorithms, which help Parsyl to understand if, when and where products have experienced spoilage during shipment or storage. Parsyl automatically analyzes data and informs customers of temperature breaches. When issues occur, payment is made in 72 hours, giving shippers the cash they need to bounce back from a loss.

“Niceland has always prioritized food quality and safety above all else. When businesses like ours lose product due to supply chain issues like temperature fluctuation, we can be left in the dark while claims are investigated. By combining temperature monitoring with cargo insurance Parsyl hits two pain points at once - collecting objective data and using it to hold actors in the supply chain accountable,” said Oliver Luckett, Chairman of Niceland Seafood.

The ColdCover cargo insurance suite includes everything needed to insure perishable cargo, such as pharmaceuticals and life science products, seafood, fruits, vegetables and agricultural commodities, and includes a staggered payment option to ease the upfront costs of buying cargo insurance.

The ColdCover product suite includes:

- ColdCover Parametric: Single Peril transit cover for spoilage due to temperature

- ColdCover Buyback: Deductible Buyback for All Risk transit and STP policies

- ColdCover Transit: All Perils cargo policy for theft, loss or damage to products in transit

- ColdCover Stock + Transit All Perils cover for theft, loss or damage to products in transit and/or stored in inventory

“The way Parsyl is using its data to deliver new products and value for hard to insure perishable risks is exactly the type of innovation the cargo insurance industry needs. We are thrilled to partner with a company so advanced in their thinking and technology, meaning we are now able to deliver unique solutions for both clients and markets,” said Gordon Longley, partner and head of marine at McGill and Partners, and partner and trusted advisor to Parsyl.

The company also announced that it has raised $15 million in Series A funding, led by GLP, a major investor in logistics and related technologies, and Ascot Group, a leading commercial insurer and top performing Lloyd’s syndicate. Parsyl is an approved Lloyd’s Coverholder and is licensed to offer cargo insurance products in Alaska, California, Colorado, Louisiana, Maine, Massachusetts, Oregon, Texas, Virginia, Washington and the United Kingdom. Parsyl will use the funding to launch its insurance product suite in additional states in the coming months, advance industry specific product degradation algorithms and expand its team.