For the past 3 years, the trucking industry has faced numerous challenges stemming from the onset of COVID-19. However lately, the disruptions have become more… disruptive and less predictive.

Present day, it’s not just a lack of visibility that’s creating bottlenecks along the way; today’s challenges run deep, are more personal and stem from a variety of causes such as the passage of certain laws, the lack of agreements to better protect contract workers and more.

And, sometimes even the most cutting-edge technology can’t predict what’s going to happen next.

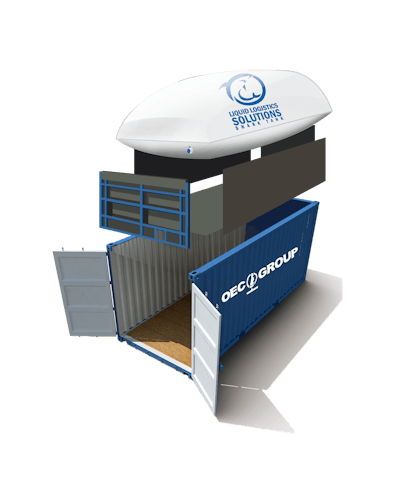

Marina Mayer, Editor-in-Chief of Food Logistics and Supply & Demand Chain Executive, talks exclusively with Lynn Stacy, managing director OEC Group – Liquid Logistics Solutions, details why Mobility-as-a-Service (MaaS) makes for improved visibility and infrastructure across the supply chain.

CLICK HERE to read the article in full.

Food Logistics: The California Air Resources Board voted unanimously to finalize its Advanced Clean Fleets rule, which requires all new medium- and heavy-duty vehicles sold or registered in the state of California to be zero-emission come 2036. What does this mean for the future of trucking and transportation?

Lynn Stacy: At least in the short-term, the cost of trucking services originating in California will likely increase. Carbon credits, though, should help offset some of the initial investments trucking providers will need to make on updating their fleets of vehicles to comply with the zero-emission mandate. Shippers that leverage these services correctly may be able to earn carbon credits, as well. There are also lingering questions about how this will impact fuel surcharges and whether or not charging fees will be implemented (either instead of or in addition to fuel surcharges).

Food Logistics: The FMCSA changed its Hours of Service regulations to allow some expansions to the workday. Thoughts on how this helps/hurts the transportation industry?

Stacy: That allowance from the FMCSA is based on operational needs that have been clearly demonstrated at pandemic peaks and even now in a much slower market. Extended hours, especially at certain gateways like LA-Long Beach, will fill a clear market need, and flexible hours of service regulations will allow for more cargo to moved overall. Shippers may have to pay after-hours fees depending on their relationships with a specific port or their provider, but it seems like this change will be overwhelming positive from a freight processing standpoint.

OEC Group – Liquid Logistics Solutions

OEC Group – Liquid Logistics Solutions

Food Logistics: Electrification in trucking continues to become more prevalent. In fact, the Infrastructure Investment and Jobs Act (IIJA) allocated $7.5 billion to establish long-distance EV traveling and install charging stations near residences or workplaces. What is your take on the future of EVs, and how likely is the supply chain industry in adopting this alternative fuel source?

Stacy: Based on new IMO rules, transitioning to EVs won’t be much of a choice. The industry will have to adopt this technology in some degree to be compliant with new regulations, and it’s much smarter to get ahead of the curve than waiting until the final hour. As far as the future of EVs and how exactly the industry will leverage the alternative fuel source, there are a few primary things to consider.

The first is the infrastructural development that will have to happen before we can truly cover the entire country with an EV distribution network. It’s very difficult to say how quickly that may happen, especially when you consider how infrastructural updates throughout the supply chain are constantly lagging.

Second, delivery speed has to be considered. It’s not yet certain how different average transit times will be with recharging rather than refueling, and how that in turn will disrupt haulage wages, expected delivery times, and overall cost.

That being said, managing this transition in the trucking sector should be much simpler than similar situations with alternative fuels in ocean shipping. There are far fewer vessels than vehicles, so it’ll likely be even longer before we understand the true impact and scale of the EV shift.

Food Logistics: Mobility-as-a-Service (MaaS) is also on the rise. Describe what this means for the cold food chain?

Stacy: It means faster speed to market. Mobility-as-a Service developments are going to allow products to move from warehouses to shelves quicker than ever before. If carried out correctly, this could lead to less wasted food, and it could also bolster supply chains for perishable medicines.

Food Logistics: Describe some other trends and challenges in trucking and transportation set to impact the future of cold food chain logistics.

Stacy: The pandemic exposed a lot of the challenges we will continue to have throughout the entire supply chain—cold chain included. The big underlying issue is basically that our domestic infrastructure is lagging behind global growth trends in both shipbuilding and trade in general. One major disruption, even one much less significant than COVID-19, has the potential to almost immediately cause the levels of historic congestion that we saw during the pandemic. Expanded transit times disproportionately impact the cold chain due to the perishable nature of goods that rely on it.

On the other hand, developments like MaaS, dredging and other infrastructural improvements, an industry push toward improved visibility, and even some of the pandemic-era lessons learned about diversifying shipments and leveraging alternative routes are advances that support a more effective cold chain.

Food Logistics: What are some things not addressed above that may be pertinent to our readers?

Stacy: The market appears to be resettling, but now is not the time to sit back and be idle. Demand has not yet caught up with added capacity, but as carriers continue to make capacity adjustments accordingly, rates will eventually change course. Procuring space may also be much more complicated than it is right now. Shippers, retailers, and even suppliers need to be aware that this market will shift. When it does, it’ll be extremely difficult for anyone that isn’t already prepared.

CLICK HERE to read the article in full.