When it comes to U.S. ports and ocean carriers, it’s safe to say that for a sector traditionally stagnant, it’s experienced a great deal of change over the past couple of years.

From dockworker strikes and heightened adoption of nearshoring to an uptick in fuel charges, a deteriorated infrastructure and economic uncertainty with regards to increased tariffs, the ripple effect has been – and will continue to be -- felt across all ports nationwide.

But what does this all mean for 2025? And what will the State of Ports and Ocean Carriers look like in the New Year?

Food Logistics talks exclusively with Jackson Wood, director of industry strategy, global trade intelligence, Descartes Systems Group, about container volumes, looming challenges for U.S. importers and how potential tariffs could reshape the trade landscape as we know it.

CLICK HERE to read the full article.

Food Logistics: The global container shipping industry continues to witness an increase in freight demand for U.S.-bound shipments. What does this mean? And what will this look like come 2025?

Jackson Wood: Higher demand suggests robust U.S. consumer spending along with importers accelerating shipments to mitigate potential tariff impacts in 2025. While it is difficult to predict with certainty, it is possible we will see a plateau and potentially a decline in volumes in 2025.

Food Logistics: From your vantage point, what are some of the top disruptions impacting ports and ocean carriers? And, why?

Wood: Shifting sourcing strategies put pressure on all facets of the global supply chain as capacity is either under- or over-utilized. This coupled with ongoing labor negotiations creates an environment of uncertainty for port and carrier operators.

Food Logistics: What does Donald Trump’s re-election mean for the future of ports and ocean carriers., i.e., tariffs?

Wood: Volatility and uncertainty will certainly increase under a Trump administration making it more challenging to operate and plan effectively.

Food Logistics: The International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) reached a tentative agreement on wages, extending the Master Contract until Jan. 15, 2025. What does another possible port strike mean for U.S. supply chains?

Wood: More demand will be placed on Gulf/West Coast ports, which will in turn increase port transit times and potentially costs as well.

Food Logistics: Nearshoring is becoming a more common approach to supply chain optimization. What are some of the pros/cons of nearshoring? What does this mean for the state of imports and exports?

Wood: The biggest benefit to nearshoring is the ability to shorten shipment times. The biggest con is the time it takes to reconfigure a supply chain in this way, along with potential cost increases if the previous supplier was located in a lower-cost jurisdiction.

Food Logistics: Please share any stats/market trends detailing the status of the ports and ocean carrier market as it stands end of 2024 heading into 2025.

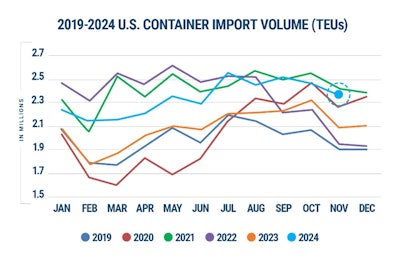

Wood: The figure below shows monthly U.S. container import volumes from 2019 through to the end of November 2024. Volumes have been strong throughout 2024. While the data shows a traditional decline in volumes in December, total imports for the first 11 months (25,829,192 TEUs) of 2024 have already surpassed the 12-month total (24,957,640 TEUs) for 2023—by 871,552 TEUs or 3.5%.

Despite a strong year in 2024 for import volumes, numerous challenges loom for U.S. importers as the year draws to a close. Potential tariff changes under the incoming Trump administration in January 2025 could significantly reshape the trade landscape. Other factors threatening the stability of global trade include the January deadline for USMX/ILA negotiations, increasing port delays on the West Coast, and the ongoing conflict in the Middle East. Together, these issues may drive supply chain volatility for the remainder of December and into the new year.

Descartes Datamyne

Descartes Datamyne