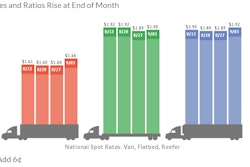

Average spot truckload rates dipped during the week ending June 20 but remain well above the averages for May, according to DAT Solutions, which operates the DAT network of load boards.

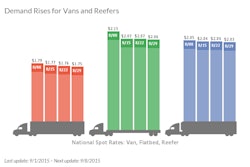

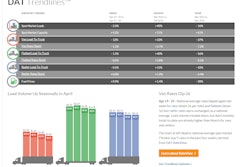

The number of van load posts declined 13 percent and available van capacity increased 3.2 percent last week, driving the van load-to-truck ratio down 15 percent to 2.0 loads per truck, meaning there were 2.0 available van loads for every truck posted on the DAT network.

Van rates responded by declining 2 cents to $1.88 per mile, the first change since a 5-cent increase during the first week of June. Average outbound rates rose in several key markets including Los Angeles, up 5 cents to $2.15 per mile, and Columbus, up 4 cents to $1.85 a mile.

Amid shifting harvest activity, demand for reefers slipped 5.4 percent and capacity added 2.6 percent as the reefer load-to-truck ratio fell 7.8 percent to 5.0. The national average rate for reefers fell 1 cent to $2.22 per mile, DAT reported. Rates continue to tumble in Southern Florida—the average reefer rate out of Miami dropped 21 cents last week—but jumped in key California markets.

Flatbed load availability dropped 13 percent last week while flatbed capacity added 13 percent. The flatbed load-to-truck ratio declined 23 percent to 20.6, which still indicates strong demand. The national average rate for flatbeds slid 1 cent to $2.19 per mile.

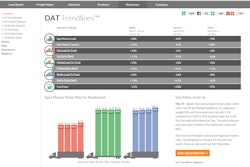

Rates are derived from DAT® RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends.

Load-to-truck ratios represent the number of loads posted for every truck available on DAT load boards. The load-to-truck ratio is a sensitive, real-time indicator of the balance between spot market demand and capacity. Changes in the ratio often signal impending changes in rates.

For complete national and regional reports on spot rates and demand, visit dat.com/Trendlines. DAT Trendlines is a weekly report on spot market freight availability, truck capacity, and rates.