An unusual surge of truckload freight led to higher-than-normal volumes on the spot market during the week ending July 29, said DAT Solutions, which operates the DAT network of load boards.

The number of available loads increased 2 percent, while truck posts edged down 2 percent compared to the previous week. National average load-to-truck ratios stayed firm: the van load/truck ratio was 5.3, up from 4.8, while flatbeds remained at 36.1, and reefers held at 8.5.

Typically, July is a month when spot truckload freight activity begins to decline.

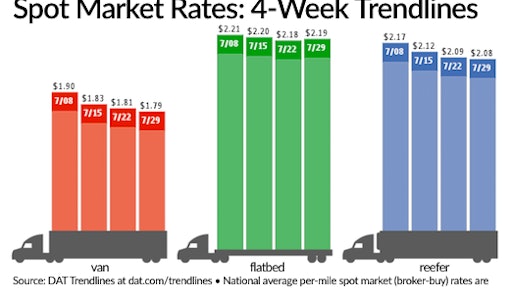

In the van market, the top 100 van lanes set all-time records for volumes last week. Nationally, load posts increased 6 percent, and posted truck capacity decreased 2 percent. Rates did not respond: the national average van rate fell 2 cents to $1.79/mile. Chicago ($2.08/mile, down 1 cent), Los Angeles ($2.15/mile, down 3 cents), Houston ($1.76/mile, down 3 cents) and Charlotte ($2.16/mile, down 3 cents) trended lower for outbound spot van rates.

Reefer demand remains strong for late July, as load posts increased 5 percent, and truck posts declined 2 percent. The national average rate fell 1 cent to $2.08/mile.

Regionally, harsh weather is taking a toll on crops but several lanes showed solid gains:

- Grand Rapids to Cleveland added 50 cents to $4.12/mile.

- Grand Rapids to Madison rose 32 cents to $3.19/mile.

- Chicago to Atlanta was up 32 cents to $2.59/mile.

- Sacramento to Denver added 26 cents to $2.55/mile.

The highest outbound average reefer rate last week was Green Bay, a penny higher at $2.88/mile. Chicago added 11 cents to $2.46/mile.

Flatbed load posts declined 1 percent last week, while truck posts fell 4 percent. At $2.19/mile, the national average flatbed rate was 1 cent higher compared to the previous week.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.