What are you doing to be sustainable? It’s a question that people have been asking for several years now. And it’s an especially important question for the food and beverage (f&b) industry since f&b uses more natural resources than most industries. Which is why every year, f&b companies invest in new ways to operate more sustainably.

To calculate the amount of investment f&b companies make in sustainability would be almost as difficult as trying to quantify how much time, energy, resources and waste are being saved as a result of these efforts. For the purpose of today’s discussion, it’s sufficient to say that these initiatives continue to expand. Consumer research has confirmed that the public wants food to be safe and also wants business to contribute to the well being of society and the environment. And the f&b industry is listening.

Sustainability refers to environmental and social responsibility.

Grant Thornton LLP, a Chicago-based audit and advisory firm, researched what f&b companies are doing to make their operations more sustainable and why. The biggest takeaway from the 2014 survey, “The State of Sustainability at Food and Beverage Companies,” is that sustainability has become a competitive advantage. The study measured attitudes about sustainability from 189 respondents at U.S. f&b retail, distribution and manufacturing companies.

Top findings include:

• Businesses are working to reduce their environmental impact, and more companies are calculating the carbon footprint of their operations.

• Cost management emerges as the key driver for corporate social responsibility, followed by customer demand and because it’s the right thing to do.

• How a business is perceived to be operating is also important.

• The majority of f&b businesses are involved with local charities, either through donating time, money or products/services.

Forty-four percent of respondents rated sustainability as extremely important or important in their company’s business strategy. Nearly 70 percent said sustainability is critical to growth (68 percent), long-term profitability (68 percent), expected by customers (67 percent) and a competitive differentiator (64 percent).

One of the most critical findings is that companies that invest in these initiatives are seeing a strong ROI.

How f&b prioritizes sustainability

The study also uncovered differences in how different types of f&b businesses prioritize sustainability.

Retailers are more likely to reduce energy consumption and pursue paper and packaging recycling.

Kroger, for instance, tested and adopted hydrogen fuel cells to power material-handling fleets at its Compton, Calif. DC, which supplies groceries for Ralph’s supermarkets, the study notes. The site decreased maintenance costs by approximately 20 percent. And since hydrogen fuel cells emit less heat and water, they reduced the forklift-generated carbon footprint.

Manufacturers are more likely to reduce production waste. Manufacturers also are also more likely to measure sustainability efforts (87 percent of suppliers versus 74 percent of retailers and 56 percent of wholesalers).

Wholesalers, who rarely sell directly to consumers, were the least likely to engage in sustainability activities and were significantly less likely to reduce energy consumption and fund social programs. Wholesalers were the most likely to say that sustainability is a fad that will disappear in a few years (25 percent of wholesalers versus 7 percent of retailers and 4 percent of suppliers.)

Tax credits and incentives

The survey also noted that government tax credits and incentives allow companies to recover part of their sustainability investments. Nearly one in five (19 percent) reported saving money through local green tax incentives and 8 percent through federal programs.

At the same time, 31 percent of survey respondents were unaware of credit and incentive opportunities. Wholesalers, especially, are largely uninformed about them (48 percent).

Walmart steps forward

In researching individual company initiatives, Food Logistics found that many of the country’s leading food retailers and manufacturers have invested heavily in sustainability initiatives over the years, and these efforts continue.

Walmart, the largest food retailer, has taken a major leadership role with sustainability. It has demonstrated leadership in its own operations and has set sustainability goals for its product suppliers. The company launched its Sustainable Product Expo more than 10 years ago, a three-day collaboration to expand the availability of products that sustain people and the environment.

In October 2014, Walmart announced four pillars for providing a more sustainable food system: 1) improving the affordability of food, 2) increasing food access, 3) making healthier eating easier and 4) improving the safety and transparency of the food chain.

Walmart also launched its “Climate Smart Agriculture Platform” to drive improvements in agricultural productivity through efficient use of fertilizer and water. By the end of 2014, the company had established joint agricultural partnerships with 17 suppliers, cooperatives and service providers on 23 million acres of land, with the potential to reduce 11 million metric tons of greenhouse gas (GHG) by 2020.

F&b manufacturers, encouraged by retailers and consumers, have embraced similar initiatives.

“We have worked with our retailers to advance their sustainability strategies for several years,” says Niki King, senior manager for the corporate social responsibility program office at Campbell Soup Co. “A great example would be the work we have done with Walmart in the areas of greenhouse gas reduction, sustainable agriculture and even hunger relief.” One goal is to eliminate 100 million pounds of packaging by 2020 from Campbell products.

Most of the multi-national f&b manufacturers release yearly global sustainability reports that detail progress in sustainable agricultural sourcing, energy efficiency, waste reduction and recycling, water efficiency, packaging reduction, health and wellness initiatives, protecting animal welfare, and social and community involvement.

F&b companies of all sizes, however, are embracing sustainability. The sidebar stories accompanying this article profile four smaller size companies that invest in sustainable activities.

“We aim to use the power of business to make the world a better place,” Sandy Yusen, a spokesperson for Keurig Green Mountain, tells Food Logistics.

This past year, the company updated its responsible sourcing supplier guidelines and worked to communicate them across its supply chain. The company also developed a new data management tool — the sustainability performance management system — to streamline efforts to track, measure, and communicate the impact of its sustainability efforts.

The company’s latest initiative is ensuring that 100 percent of its Keurig K-Cup pods are recyclable by 2020.

Continuing focus: carbon reduction

While sustainability encompasses many aspects, reducing the carbon footprint has emerged as an area that many companies address. Reducing the carbon footprint includes energy efficiency and waste reduction.

Nanci Tellam, group director of environmental services at Ryder System Inc., says a growing emphasis on carbon management has caused more customers to ask the company about sustainability. “Mostly, our customers are looking for data related to their own emissions and are hoping to leverage some of our best-in-class technologies and programs to improve their operations and environmental programs, as well as reduce emissions,” she says.

Ryder has committed to reducing energy consumption at operating facilities by 20 percent —below 2009 levels — by 2020, using employee awareness and training, conservation upgrades at its locations, and installation of energy efficiency lighting at shop locations.

Ryder also recycles nearly all automotive waste streams, including 3 million gallons of used oil, as well as automotive filters, solvents, and used tires. The result is the prevention of approximately 22,000 metric tons of GHGs annually, which is equivalent to more than 50,000 barrels of oil consumed or emissions from 4,000 passenger vehicles.

Energy technology has become more affordable in recent years, giving f&b companies new ways to reduce their carbon footprints. “It does have to be something you can afford to do,” says Shaun McFaul, operations manager at Ben E. Keith Co., the Fort Worth, Texas-based foodservice distributor.

McFaul’s company achieved EPA LEED (Leadership in Energy & Environmental Design) gold for its new headquarters, says McFaul. The energy savings come from LED smart lighting, cooling tower rainwater capture and underground cooling tanks. “It’s only recently been cost effective,” McFaul said for the LED lighting.

Ben E. Keith Co. is also reducing fuel costs by using plug-in reefers in its staging facilities instead of running diesel engines.

Asked if the company was motivated by financial gains versus wanting to be good corporate citizens, McFaul replies, “We’re doing it for both reasons.”

McFaul concurs with the observation that foodservice in general has not been as aggressive investing in sustainability as f&b retail and manufacturing. “A lot of foodservice doesn’t have as much infrastructure as a lot of the (big) retail,” he says. But he’s quick to point out that foodservice distributors are investing more in energy efficiency.

Logistics plays a key role

Logistics often plays an important role in reducing the carbon footprint. Ocean Spray Cranberries Inc. was able to ship product more efficiently by partnering with fruit shippers and a rail operator to claim unused cargo space in returning boxcars from New Jersey to Florida.

“An existing logistics partner made us aware of an opportunity to utilize back-haul capacity from New Jersey and Florida,” Earl Larson, director of supply chain at Ocean Spray, tells Food Logistics. “We were pleased to leverage this largely untapped opportunity for collaboration between companies in order to reduce costs and emissions together. In total, over the 12-month period, emissions and transportation costs in the southeastern corridor were reduced by 20 and 40 percent due to the initiatives we implemented.”

Glanbia, an Ireland-based global nutritionals and dairy business group, improved vehicle utilization by 15 percent and reduced the annual number of routes by 10 percent using Paragon Software transportation optimization software. This reduced more than 100 tons of CO2 emissions per year and improved service levels to the marketplace. “We have been able to make significant reductions in usage and emissions while improving efficiencies of our delivery operation,” says Denis Conway, national logistics manager at Glanbia Consumer Foods Ireland.

Packaging reduction

Packaging reduction has emerged as a way to reduce the environmental footprint for many companies.

Robert Ulery, vice president of solution design in retail logistics at GENCO, a FedEx company and 3PL based in Pittsburgh, Pa., noted that packaging costs can be greater for products sold through traditional retail channels. Hence, the manufacturers and retailers of consumer goods have more incentive to invest in recyclable packaging solutions.

Ulery says that 3PLs are investing more in sustainability practices because it’s good for the environment, plus it’s a way for customers to differentiate themselves in the market. “We focus on going above and beyond what our clients ask us to do. That includes considering sustainability in our solution design process and in ongoing process improvements,” he says.

Sustainable agricultural sourcing

Food processors are increasingly turning to sourcing sustainable agriculture.

General Mills Inc. recently reported on its progress toward sustainably sourcing 100 percent of its 10 priority ingredients by 2020. These ingredients represent 50 percent of General Mills’ total raw material purchases. The company works with farmers in developing economies and larger-scale growers in developed economies to address challenges and pursue opportunities unique to each growing region.

Verification and validation

A variety of organizations have emerged to assist companies with ways to verify their sustainability claims. These include Fair Trade, the Rainforest Alliance, the Carbon Disclosure Project (now CDP), the Global Reporting Initiative (GRI), the Dow Jones Sustainability Index, the Walmart Sustainability Index, and more.

Keurig Green Mountain participates in the Fair Trade, Rainforest Alliance and USDA Organic coffee certifications. “It’s a stamp of approval that provides assurance to the consumer they are purchasing a product that is grown responsibly,” Yusen says. and business ethics. By using this common platform, we’re able to

Kellogg also began assessing ethical performance compliance through a collaborative organization called Sedex, which works with buyers and suppliers around the world to deliver improvements in responsible sourcing. Sedex offers an online database for storing, sharing and reporting on suppliers’ responsible sourcing information. Sedex’s database allows supplier companies to answer a single, uniform questionnaire about their labor standards; health, safety and environmental practices; and business ethics.

“Through our partnership with Sedex, we will identify and address risks in our supply chain,” Diane Holdorf, Kellogg’s chief sustainability officer, tells Food Logistics. “The process also helps us understand how our suppliers’ policies and programs support workers. We are in the process of identifying the risk-based priorities within our supply chain and will be reporting on our progress over time.”

Kellogg developed the Kellogg’s Origins Grower Survey tool. The survey asks farmers for data on environmental, social and economic indicators such as energy, water and fertilizer use; number of smallholder and women farmers and existing supporting programs (where appropriate); and climate risk and adaptation measures.

Waste reduction

Waste recycling and reuse is another sustainability initiative.

In 2014, General Mills reused or recycled 87 percent of its waste in North American operations, up from 85 percent in 2013.Reuse increased from 14 percent to 23 percent of the total and landfill decreased from 14 percent to 12 percent. Recapturing value from waste has become a revenue source for General Mills, representing a record $10 million of net revenue in 2014 for North American operations.

Water reduction emerges

Water reduction has become a more sustainability goal for many companies, especially in light of the California drought which has resulted in mandatory reductions in consumer water use.

Nestle Waters claims to be working to reduce water us in its bottling and our manufacturing operations by 10 to 30 percent.

Coca-Cola Co. has mandated all of its bottling plants to assess the quality and quantity of their local water sources and to develop and implement comprehensive source water protection plans. The company also reported continuous improvement in its plants water use ratios from 2004 to 2013.

Keurig Green Mountain in early 2014 conducted a comprehensive water footprint

of the value chain related to the creation and use of its coffee portion packs to more fully understand the impact of its products and identify areas for improvement.

The findings indicate that the company is not a large direct consumer of water and that the brewers actually promote water savings.

“We believe our products lend themselves to water savings,” Yusen says.

The company announced a new target to balance the water used in its 2020 brewed beverage volume of all beverages, ounce for ounce, through projects that restore water for natural and community uses.

For Ryder System Inc., water use is primarily associated with truck washing. “Vehicle washing is performed daily at most Ryder facilities and all wash services are performed in accordance with our environmental policies that are designed to maximize reuse, recycling, and pre-treatment discharge solutions,” Tellam says.

Supply chain transparency

Many companies are focusing on supply chain transparency as part of their sustainability efforts.

Coca-Cola Co.’s “Pass It Back” program attempts to achieve end-to-end visibility of respect for human rights by working with eligible suppliers to pass its workplace rights expectations back through the supply chain. The company works with suppliers in the program to ensure alignment of policies and due diligence measures and request transparent and routine stewardship reporting.

The Hershey Co. recently announced the results of its first phase in tracing its global palm oil supply chain. Working in partnership with The Forest Trust (TFT), Hershey has traced its supply chain to more than 94 percent of all the mills that supply its palm and palm kernel oil globally. Hershey’s supply mapping has given the company insight into its palm oil sources from suppliers originating back to the mill level. This will help the company better understand if any sourcing is linked to areas of potential deforestation or social challenges within the production of its palm oil.

“Our customers are seeing the same demands we are for transparency because consumers are increasingly expecting more from their favorite foods and brands,” says Kellogg’s Holdorf. “This is one of the reasons we partner with retailers to understand consumer trends and needs. And in some cases, we’re also collaborating with retailers to deliver sustainability goals that optimize supply chain innovation and change. Last year, for example, Kellogg and Wal-Mart announced a joint commitment to help support the livelihoods of rice growers and improve rice crop sustainability.”

How To Get Started With Sustainability

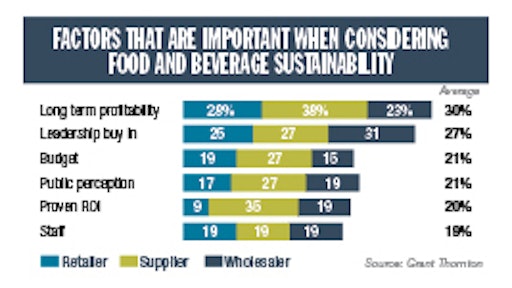

The Grant Thornton LLP study on f&b sustainability examined the factors that are critical when considering and planning sustainability programs. The most widely noted factors include support from the c-suite, a focus on profitability and measurable performance targets.

Leadership buy-in (27 percent) is one of the top two factors (profitability is the first) for companies when considering sustainable practices.

Another important factor is the organization’s overall risk profile and how sustainability will affect it. Companies must consider questions such as: If I change suppliers, am I moving to a supplier with less financial stability, or one operating in a country with less geopolitical stability?

Seventy four percent of respondents said that their company measured sustainability efforts. Energy consumption (58 percent), total waste (50 percent) and amount of recycled materials (40 percent) were the most frequently mentioned ways of measuring sustainability efforts.

Independent Oregon Grocer Invests $2.5 M In Sustainability

Newport Avenue Market, an independent grocery store in Bend, Ore., has invested more than $2.5 million in technologies to reduce the store’s carbon footprint in the last few years.

One technology has been electronic shelf tags from Sweden-based Pricer AB, replacing paper tags. The tags “sleep” at night to conserve energy, allowing the batteries to last nearly one decade. The tags also reduce a fair amount of labor since the information on the tags can be changed from a desktop. In addition, they are well received by customers, notes Lauren Johnson, chief operating officer.

The store has also added new, state-of-the-art, refrigeration cases with glass doors from Bridgeton, Mo.-based Hussmann that use 70 percent less energy than the previous cases, which were open. The energy savings has allowed the company to qualify for state rebates.

The store was also honored for its waste composting program. The award recognized Newport Avenue Market as the first company of its size to have such a program.

“We’re always trying to keep up with the latest technology trends, think of innovative ways to keep our customers happy, and maintain that great shopping experience that Newport Avenue Market offers,” Johnson says.

California Caterer Scores High With Natural Degreaser

Max Catering in Palmdale, Calif. has benefited in several ways from an organic degreaser that carries the EPA’s “Safer Choice” label, according to Mitchell Frieder, company owner and chef. Naturama CBD from Las Vegas-based Green Life Development Inc. keeps the kitchen clean without the need for toxic chemicals. Being a natural product, Naturama protects Frieder and his employees from toxic exposure.

Frieder, who also teaches at the International Culinary School at the Art Institute, has been happy to replace his chemical cleaners. Chemicals, in addition to carrying potentially dangerous fumes, left unpleasant odors. The Naturama degreaser works faster than chemical products and it can be used in a variety of environments, such as preparation equipment, kitchen floors, on windows, even on vehicles.

Frieder’s first priority for any cleaner is effectiveness. Sustainability is a secondary concern.

The common complaint about natural or “green” cleaners is that they aren’t as effective as chemical products. Frieder found this to be the case with other natural cleaners he used.

Naturama CBD, he discovered, removes grease quickly from equipment, walls, windows and hoods. In using it on floors, he says it made the floor more resistant to slips than any product he has used. “It strips grease, oils and fats out of floors amazingly well,” he says.

Naturama CBD – whose formula is proprietary – carries the EPA’s “Safer Choice” label, which promotes safer product design and green chemistry alternatives through “informed substitution,” the considered transition from a chemical of particular concern to safer chemicals or non-chemical alternatives. More importantly, Naturama CBD also meets the EPA’s Direct Release criteria, meaning the product is considered so safe that it can discharged into the environment, bypassing sewage or septic systems.

Coffee Industry Pioneers Sustainability With Fair Trade And Other Certification

The coffee industry boasts one of the most visible programs for sustainable through its Fair Trade certification, which has entered its third decade. In the Fair Trade model, producers charge a premium, and the extra charge is intended to support coffee workers and the environment. A key aspect of the Fair Trade program is its certification. Various organizations serve as third parties to validate the Fair Trade claim.

In recent years, new causes have emerged, bringing new certifications. The “Bird Friendly” label from the Smithsonian Migratory Bird Center of the National Zoo certifies coffee is shade grown to protect bird habitats.

Cause certifications have not been without their critics. But many coffee producers say these certifications educate consumers about sustainability.

“The certification is the only way the end user knows this coffee comes from where it says it comes from,” says Bill Wilson, owner of Birds & Beans in Boston, Mass., a roaster who carries USDA Organic, Fair Trade and Bird Friendly certified coffees. Among his certifications, Wilson says USDA Organic is the most recognized by the consumer. He sees Fair Trade and Bird Friendly as stricter organic certifications, with the latter being the “platinum.” In time, these lesser known certifications will be better understood. “I think we’ve been successful in heightening the awareness of what Bird Friendly certification means.”

Wilson also thinks Fair Trade is gaining acceptance among consumers. “I think it’s a respected certification among the consuming public,” he says. “Consumers like Fair Trade certification since they know that there’s a certain element of social justice in it.”

Goya Foods Opens Headquarters To Provide Net Zero Carbon Foot Print

Goya Foods, the largest Hispanic-owned food company in the U.S., opened new state of the art and sustainable corporate headquarters in Jersey City, N.J. as part of a $500 million global expansion over the past 10 years.

Constructed to provide a net zero carbon foot print, the facility will be 100 percent powered by a solar-powered energy system using 12,000 panels on 11 acres of rooftop. The system will fulfill the entire facility’s electrical needs without drawing any energy from the public grid. This translates into the ability to generate enough energy to power 30,000 homes on an annual basis.

“We are very excited to complete this stage of our strategic plan and to reap the overall benefits that it will provide,” says Peter Unanue, executive vice president of Goya Foods. “We recognize the important role businesses play in leading the way for social and environmental change. Each new facility will enable us to operate more efficiently and environmentally friendly as well as support our growth for many more years to come.”

Penske’s Sustainability Initiatives Cover A Wide Gamut

Penske-owned facilities in North America engage in a variety of sustainability practices. The company specs all of its equipment for maximum fuel savings, including the latest engine and exhaust technologies, aerodynamic devices and auxiliary power units.

Metrics from onboard systems identify inefficient vehicle or driver performance that can be corrected through operating parameter adjustments and driver training.

There is an annual GHG emission inventory for all company operations. Penske Logistics discloses GHG emissions information and energy usage/reduction efforts to the Carbon Disclosure Project.

Energy audits identify opportunities to save money and reduce the carbon footprint. This includes upgrading to more efficient lighting, supporting renewable energy through purchase of renewable energy credits, waste management/recycling programs, and solid waste and electronics recycling.

Free Flows Wines Raises Its Glass To Sustainability

By Lara L. Sowinski

The wine-on-tap movement is becoming more popular and shedding consumer misperceptions glass by glass, thanks to pioneer and industry leader Free Flow Wines—a true market disrupter whose logistics and delivery solutions are clever—and sustainable.

According to Jordan Kivelstadt, CEO and co-founder, the concept came about during a particularly bad day at work about seven years ago. At the time, he was working at a winery, where like most other wineries, it was common practice to use kegs for storing extra wine that couldn’t fit into the barrels.

“I remember thinking, ‘Why can’t we just sell wine in one of these?’ That’s when the light bulb went off,” recalls Kivelstadt. The idea for using stainless steel kegs to transport premium wines to restaurants, hotels and other retail outlets, which not only eliminates bottles, but also spoiled and oxidized wine, was born. Today, more than 450 premium wines are available in the Free Flow format throughout the U.S. And since 2011, Free Flow Wines and its winery partners have kept millions of bottles from ending up in U.S. landfills.

A critical piece of Free Flow Wines’ success is its ERP system, says Kivelstadt. “Early on, I realized that we had to build a scalable platform for interacting with lots of customers. We had a complex pipeline, and we had all of these assets (stainless steel kegs) that we needed to track to make sure they came ‘home.’”

Free Flow Wines chose NetSuite’s ERP system. “We had to have a fundamentally integrated platform and a company that could scale as fast as we were scaling,” says Kivelstadt. “NetSuite allowed us to create something unique—an asset tracking module. Even though they didn’t offer exactly what we needed with the asset tracking module, we didn’t want to have an ERP platform that would have forced us to work with a completely independent system; something that couldn’t ultimately communicate with the ERP.”

It’s the flexibility of NetSuite’s ERP that was attractive to Free Flow Wines. “One of the things we really liked about NetSuite is the open API (application programming interface). It’s basically an invitation for people to create programs that can interact with NetSuite. That was hugely important because it allowed us to find companies that could write custom code to build our asset tracking module and have it completely integrated into the ERP. It looks, acts and feels like it’s a part of NetSuite. It gives us the ability to operate our entire company under one umbrella.”

Kivelstadt emphasizes that, “Sustainability is one of the four tenets of our company. I’m a big believer in the double bottom line. I think that whenever possible, you should create a company that is both profitable and does something good for the environment.” He explains that, “One, we’re a green certified business. Two, our kegs have thus far kept more than 5 million bottles from the landfill.”

The business model also cuts down on wine corks, cases and other materials that add to the waste stream. Furthermore, the company overhauled its Napa, Calif.-based facility in 2013 to recycle 99 percent of all water used to clean the stainless steel kegs, which helped the company save about 1.5 million gallons of water annually, adds Kivelstadt.

For more information:

Carbon Disclosure Project, 212-378-2086, cdp.net

GENCO, 800-677-3110, genco.com

EPA Smartway, 734-214-4767, epa.gov/smartway

Global Reporting Initiative, 31(0) 20-531-00-00, globalreporting.org

Grant Thornton LLP, 414-289-8200, grantthornton.com

Green Life Development Inc., 702-448-6977, greenuses.com

NetSuite, 877-638-7848, netsuite.com

Paragon Software, 888-347-5462, paragon-software.com

Penske, 888-236-3560, www.gopenske.com

Ryder System, Inc., 800-793-3765, www.ryder.com

Sedex, 888-487-6146, sedexglobal.com

Smithsonian Migratory Bird Center, 202-633-4202, nationalzoo.si.edu

The Forest Trust, 206-414-0758, tft-earth.org